LEARN

11x better conversions

3x more product engagement

44% more likely to add a product to cart

Interactions with products that feature 3D AR models achieve 94% higher conversions

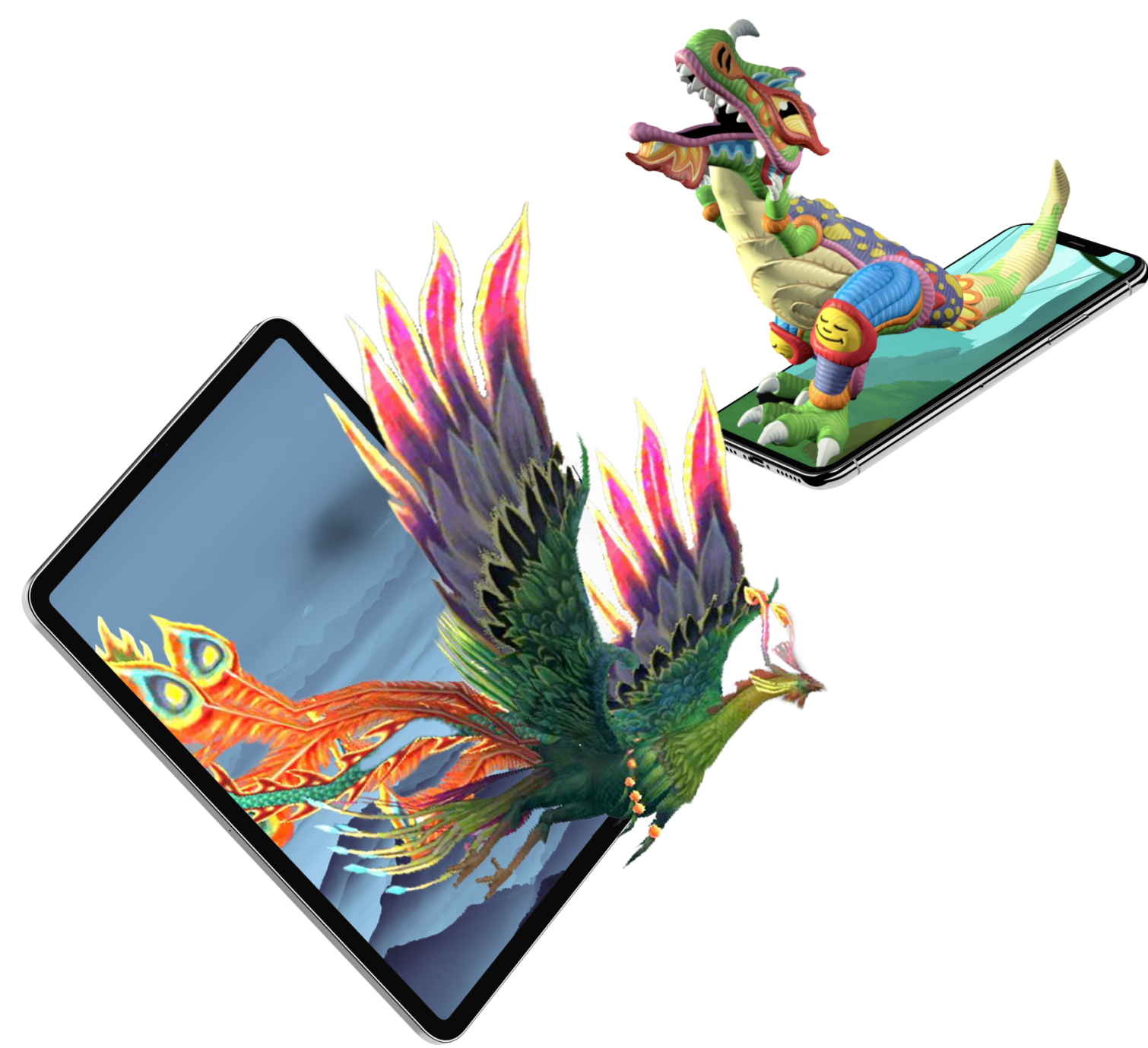

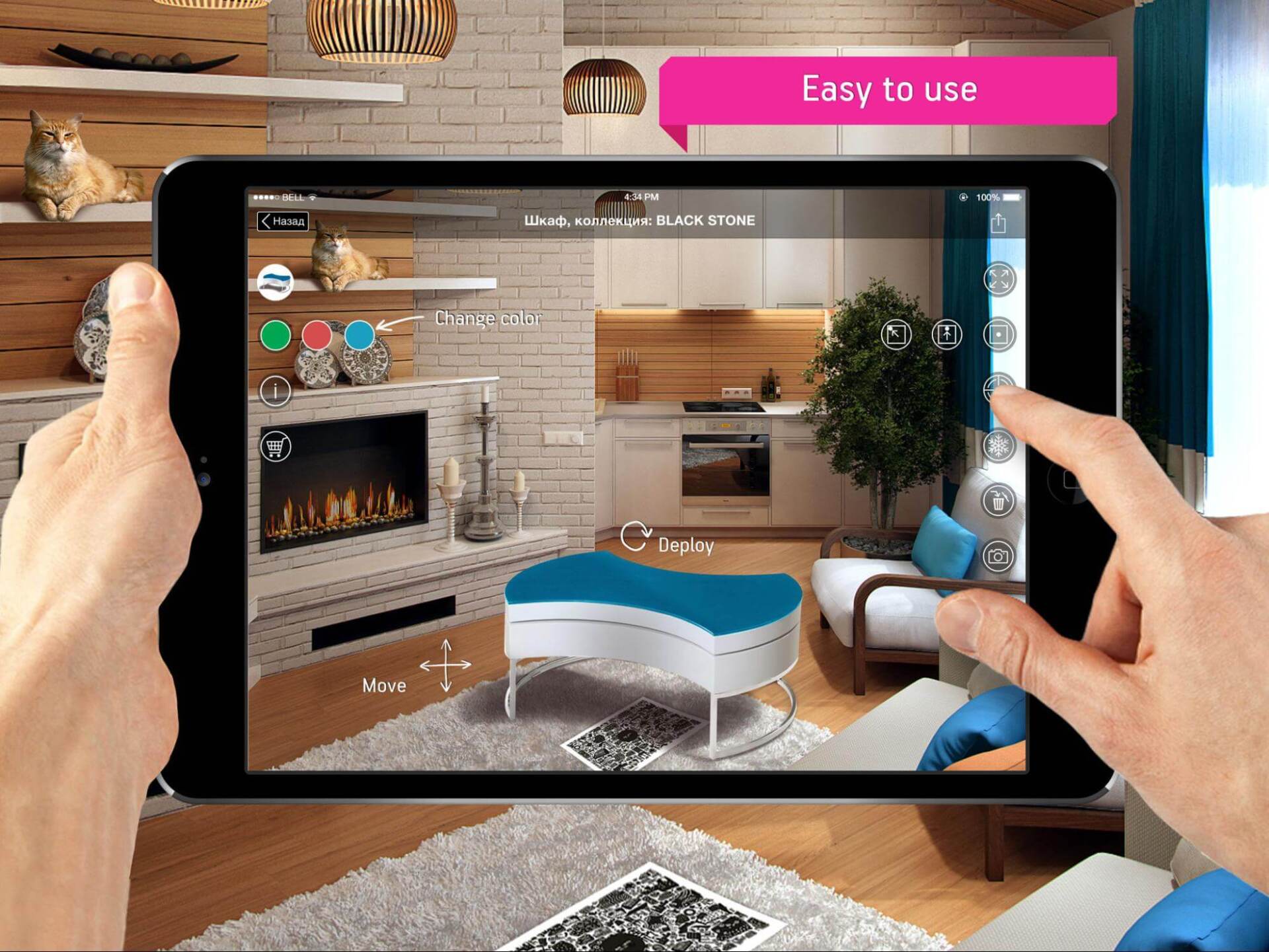

Shoppers are 10x more likely to purchase a product after visualizing it in AR and brands are seeing 3x more product engagement.

Use Cases: "Try Before You Buy" Product Visualizations, Interactive Product Configurators, Virtual Stores

Drive Foot Traffic to Your Location Using Augmented Reality Murals

AR Murals mix 3D immersive & interactive technologies with public art to create impactful and memorable brand experiences.

Use Cases: NFTs, AR Murals & Public Art Installations, Interactive Merchandise, Virtual Art Galleries

Augmented Reality drives 2x higher levels of visual attention in the brain and 70% higher levels of memory encoding

Help students learn faster and remember more by putting them inside immersive & interactive 3D AR learning experiences.

Use Cases: Digital Twins, Immersive & Interactive AR Learning Experiences, Simulations

Go Viral and Generate Millions of Brand Impressions with User Generated Content

AR experiences are user-generated content machines that can produce millions of viral fan videos and photos.

Use Cases: Bring Print & Packaging to Life With AR, Branded Mini-Games, Social AR Filters, Virtual Events

Increase Skills and Efficiency. Reduce Accidents and Training Costs.

Training and simulation is the fastest growing industry of VR/AR. Allowing users to "learn while doing" is not only more engaging than other forms of training but users learn quickerand trainers can get much more accurate data on their training outcomes.