8 Best Augmented Reality Stocks to Buy in 2025

8 Best Augmented Reality Stocks to Buy in 2025

Executive Summary

Augmented Reality (AR) is poised to become a major growth sector in technology, with the market expected to expand rapidly over the next decade. AR's blend of digital content with the physical environment is driving innovation, from consumer AR/VR headsets to AI Glasses that are already generating measurable ROI for Fortune 1000 companies. As a result, leading tech companies with strong AR initiatives—such as Meta, Apple, Microsoft, Alphabet (Google), NVIDIA, Qualcomm, Unity, and Snap—are well-positioned to benefit from this trend. These companies cover hardware, software, and chips, creating an AR ecosystem for investors to watch.

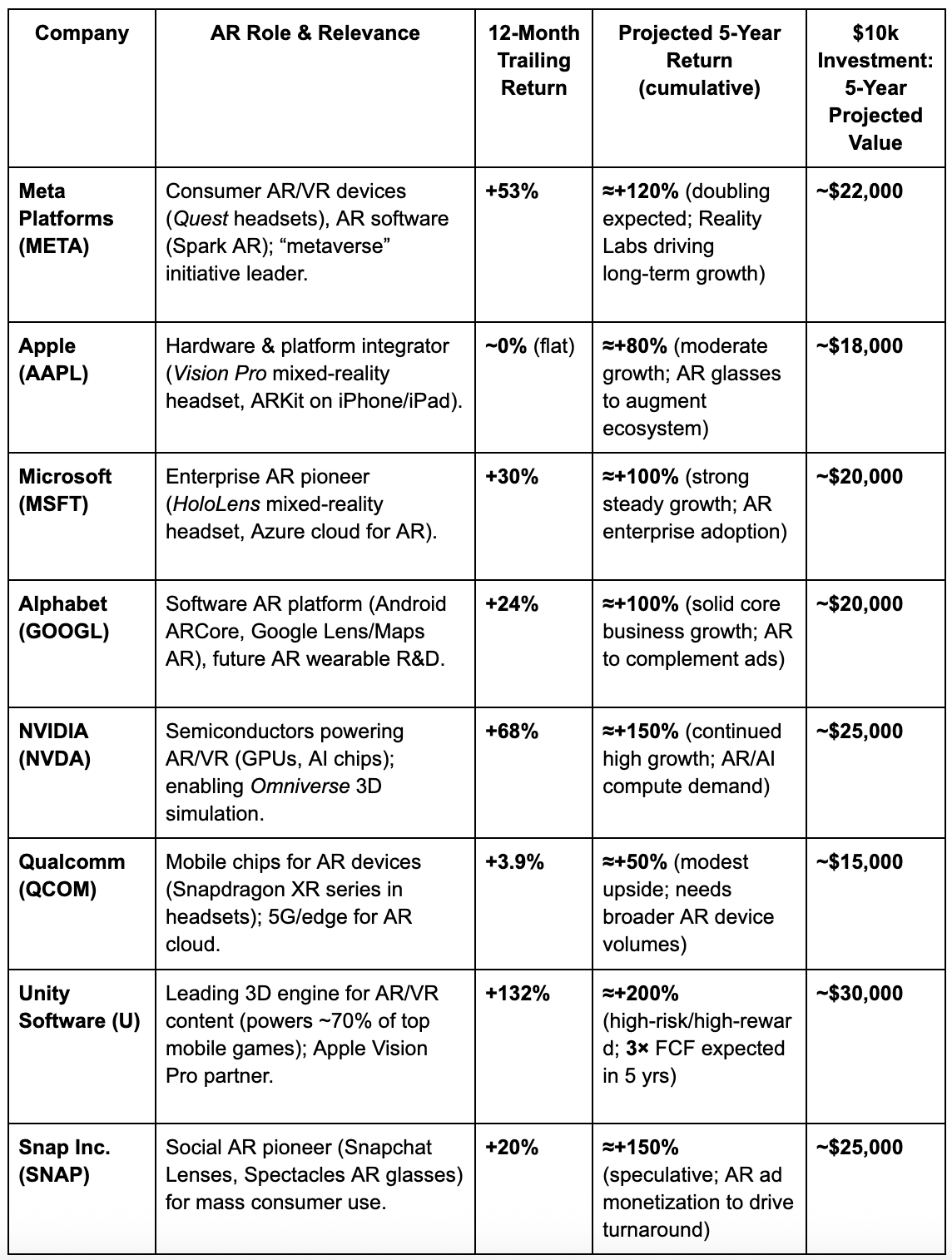

Recent Performance: Over the past 12 months, many AR-focused stocks have significantly outpaced the broader market. For example, Meta Platforms' stock has risen over 50%, and NVIDIA's has increased roughly 68%, driven by optimism around AI and the metaverse. Smaller pure-plays like Unity Software have soared (around +130% in one year), reflecting enthusiasm for AR/VR content creation. Conversely, a few large companies have underperformed – Apple's stock price remained essentially flat (~0%) amid recent market rotation, and Qualcomm only gained about 4%. Overall, a $10,000 investment in each of these stocks a year ago would have outperformed the S&P 500's approximately 20% return, highlighting the sector's strong momentum.

Strategic Outlook: Looking ahead, we expect strong returns both in the short term (next 12 months) and long term (5-year outlook) from a group of leading AR-related companies. In the near term, upcoming product catalysts—such as Apple's Vision Pro headset launch and Meta's ongoing AR/VR device updates—could boost share prices. Over five years, analysts forecast double-digit earnings growth (around 13–17% annually) for many of these tech giants, driven by AR becoming a new revenue stream. The global AR market, valued at roughly $57 billion in 2023, is projected to grow about 40% annually until 2030, offering a rising tide for companies providing AR experiences. We estimate that industry leaders like Meta, Microsoft, Google, Apple, and NVIDIA might roughly double their market value in five years (about +80–120% total return), while specialized AR companies like Unity and Snap—despite higher risk—may more than double (in the 150–200% range) if AR adoption accelerates. The table below summarizes our comparative analysis and projections for a $10,000 investment in each stock.

AR Leaders – Trailing Performance & Projected Returns (Comparison Table)

AR Market Trends and Company Analysis

AR Market Tailwinds

Exponential Growth Trajectory: The AR industry is still in its early stages but is expected to grow rapidly. Market analysts predict that the global AR market will expand from about $57 billion in 2023 at nearly a 40% CAGR through 2030, with AR advertising campaigns now delivering three times higher brand lift compared to traditional digital marketing. Similarly, the combined AR/VR headset market (around $17 billion in 2025) could surpass $250 billion by 2034, highlighting significant revenue opportunities. This growth is driven by increasing adoption in gaming, enterprise training, healthcare, retail, and industrial sectors as AR technology continues to improve.

Short-Term Catalysts (1 Year): Over the next 12 months, several product launches and milestones could boost investor confidence. Apple's Vision Pro, its first spatial computing headset, is scheduled for release and could mark its entry into AR hardware, potentially raising its stock. Meta is expected to expand its Quest AR/VR lineup and might tease AR glasses for consumers, leveraging its dominant roughly 75% market share in AR/VR devices. On the enterprise side, Microsoft's ongoing HoloLens 2 deployments and new software updates, such as Microsoft Mesh for mixed-reality collaboration, could attract more corporate and military customers. These developments, along with overall momentum in the tech sector, present near-term upside opportunities for leading AR stocks.

Long-Term Drivers (5+ Years): Over a five-year period, AR is set to become a mainstream computing platform. All the companies featured are investing heavily now to secure future leadership. Consumer adoption of AR wearables, such as smart glasses and mixed-reality headsets, is expected to rise significantly by 2030, while businesses adopt AR for increased productivity, including remote assistance and design visualization. This long-term trend signals strong revenue and earnings growth for companies involved in AR. Wall Street analysts already forecast solid five-year earnings growth for these tech giants—about 13–17% annually for Apple, Alphabet, Microsoft, and Meta—driven by new product cycles like AR devices layered over existing businesses. NVIDIA and Unity are expected to grow even faster, driven by AI and AR demand, and Snap is likely to improve its profitability path by mid-decade as AR monetization accelerates. In summary, the AR boom is a multi-year story, and companies leading AR innovation are well-positioned to deliver substantial shareholder returns.

Meta Platforms (META) – AR/VR Ecosystem Leader

Meta has aggressively positioned itself at the forefront of AR and virtual reality, making it a cornerstone of an AR investment strategy. Key points for Meta:

- AR/VR Product Leadership: Meta (formerly Facebook) acquired Oculus in 2014 and now sells the popular

Meta Quest line of VR/AR headsets. It holds an estimated

70–80% of

the VR device market, far ahead of competitors. The Quest platform (now in its third generation) provides both fully immersive VR and mixed reality passthrough (basic AR) experiences. Meta is also reportedly developing true AR glasses, aiming to be for AR what Apple was for smartphones. This vertical integration—covering devices, operating system, and app ecosystem—positions Meta as a

de facto “gatekeeper” of consumer AR/VR.

- Platform and Content: Beyond hardware, Meta provides

Spark AR, a top AR development toolkit used to create AR effects on Instagram and Facebook. Millions of creators have designed AR filters with Spark AR, boosting engagement on Meta’s social platforms. This connection between AR content and Meta’s social media user base (over 3 billion users) gives Meta a distinct edge in bringing AR to mainstream audiences.

- Recent Performance: Meta’s core advertising business has rebounded strongly, and its stock has rallied

approximately 54% over the past 12 months. This increase reflects improved financials, with 21% year-over-year sales growth in Q2 2025, and renewed investor confidence in Meta’s strategy. Notably, Meta’s over $10 billion annual investment in its Reality Labs (AR/VR) division has yet to fully translate into earnings, but investors remain optimistic. In the short term, Meta’s stock momentum is expected to continue, supported by ongoing cost discipline and potential AR/VR product announcements, such as a

Meta

Quest 4 headset or updates on its AR glasses roadmap within the next year.

- 5-Year Outlook: Meta’s long-term goal is to develop the

metaverse, an AR/VR-based successor to today’s mobile internet. If this vision comes true, Meta could see

significant

growth. Even with a cautious outlook, analysts expect Meta’s earnings to grow about 17% annually, which could mean

doubling its stock price

by 2030. By then, AR and VR might make up a much larger portion of Meta’s revenue as device adoption increases. We estimate

around a 120% total return over 5 years for Meta’s stock, turning a $10,000 investment today into approximately

$22,000. This assumes Reality Labs starts contributing profit (or at least loses less) as AR/VR use expands. Meta’s upside could be greater if it becomes a true leader in the metaverse; however, risks include high costs and competition. Overall, Meta presents a balanced outlook:

strength in the short term and long-term

AR potential, making it a top choice in the AR sector.

Apple (AAPL) – Integrating AR into the Apple Ecosystem

Apple is a global tech leader known for its hardware-software ecosystem, and AR is a key part of its innovation pipeline. Our analysis for Apple:

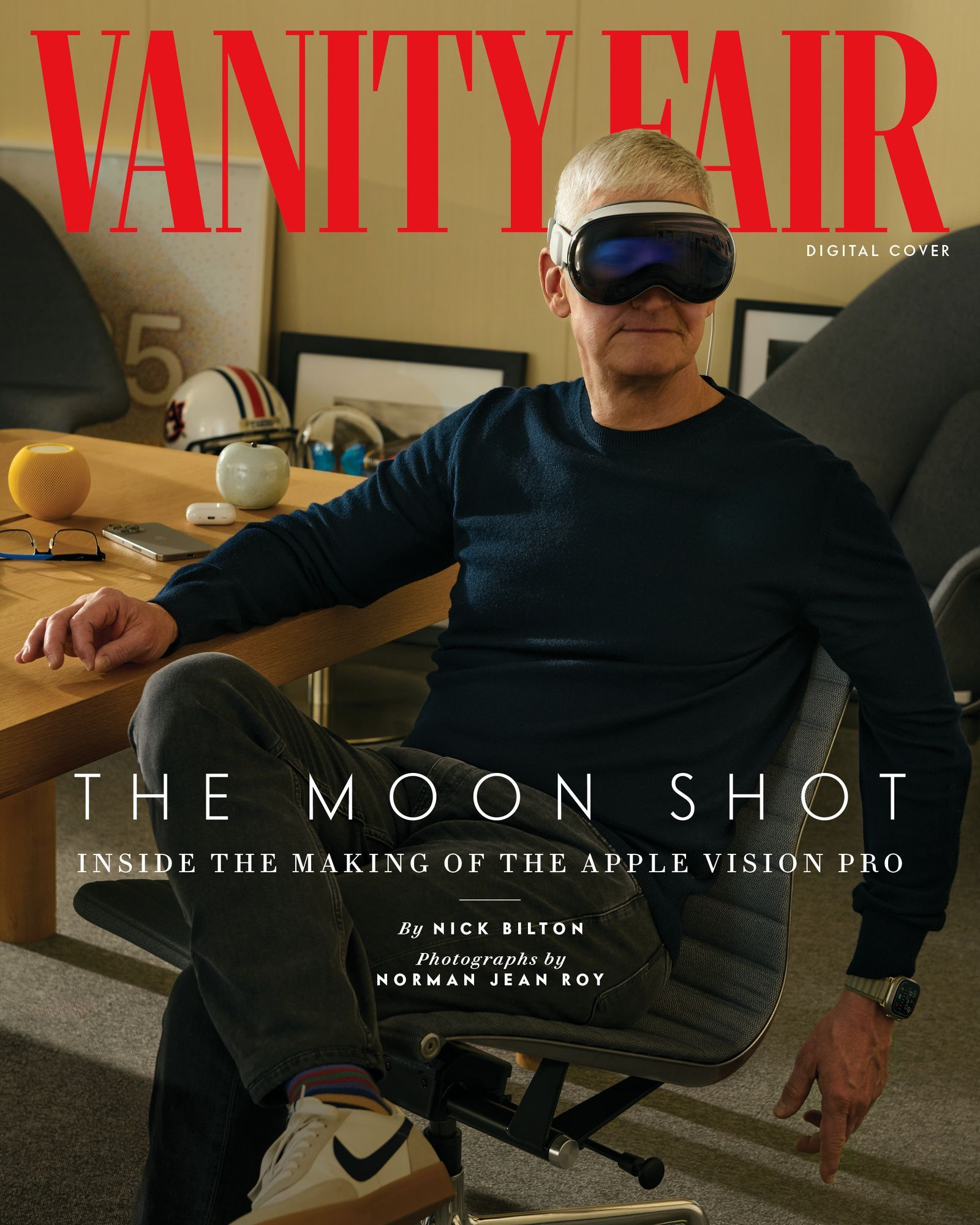

Pioneering "Spatial Computing": Apple's dedication to AR is clear with the Apple Vision Pro, its first spatial computing headset announced in 2023. Priced at $3,499 and equipped with advanced optics and silicon, the Vision Pro marks Apple's strategic entry into mixed reality (combining AR and VR) as a new computing platform. While initial production will be limited, Apple is expected to iterate quickly, with a more affordable second-generation headset rumored around 2025–26. Meanwhile, Apple has invested in AR for years through the iPhone and iPad—its ARKit software framework, launched in 2017, allows developers to create AR apps that use the iPhone's cameras and sensors. Hundreds of millions of iOS devices now support ARKit, giving Apple the largest AR-enabled user base overnight. This "AR in every pocket" approach lets Apple promote AR features—from simple visual effects to AR shopping—without requiring everyone to buy new hardware.

AR as Part of a Broader Strategy: Instead of being a standalone feature, AR for Apple is deeply integrated into its ecosystem of devices and services. For example, Apple's LiDAR-enabled iPhones allow for precise AR measurements and room scanning, enhancing apps related to home design, gaming, and more. FaceTime now features AR effects, and Apple's Maps and Search incorporate AR capabilities. Ultimately, Apple likely aims to develop true AR glasses that resemble regular eyewear—potentially a groundbreaking product comparable to the iPhone. With its strong brand, distribution channels, and developer community, Apple could become a leading player in consumer AR once the technology matures.

Recent Performance: Apple's stock has recently underperformed compared to its peers, remaining nearly flat over the past 12 months and declining about 15% year-to-date in 2025. This is partly due to strong performance in previous years and concerns about slowing device sales. The market's muted response presents a potentially attractive entry point. Apple's Q3 2025 results were actually solid, with 9.6% revenue growth, but investors are focused on future growth catalysts. AR could be one such catalyst: as Vision Pro launches (early 2025 in the US) and Apple expands AR features, sentiment toward Apple could improve. Over the next year, even modest success of Vision Pro — such as positive reviews, a developer "app moment," or better-than-expected sales — could further boost Apple's stock.

5-Year Outlook: Apple is fundamentally a steady grower—expected to increase earnings about 13% annually over the long term due to ongoing expansion of its installed base and services. We project Apple's total return over 5 years to be around +80%, turning $10K into approximately $18K. This includes some mild P/E multiple compression (since Apple is richly valued) but also solid growth. AR is a wildcard: if Apple successfully launches lightweight AR glasses by 2028 that achieve mass-market adoption, it could unlock entirely new revenue streams (wearables, App Store AR content, etc.), pushing the stock beyond our baseline estimate. Even without that, Apple will benefit from increasing demand driven by AR for high-end iPhones, iPads, and Macs that align with its spatial computing vision. In short, Apple offers lower risk and stable returns, with AR providing upside potential on top of an already dominant business.

Microsoft (MSFT) – Enterprise AR and the Industrial Metaverse

Microsoft approaches AR from an enterprise and infrastructure angle, leveraging its strength in software and cloud. Key insights on Microsoft:

HoloLens and Mixed Reality: Microsoft was an early leader in AR with its HoloLens headset, first launched in 2016. The latest HoloLens 2 is a wireless holographic device designed for enterprise and military use, such as factory training, field service, and healthcare. HoloLens introduced many AR features like hand tracking and spatial mapping, providing Microsoft with valuable experience in the field. While consumer AR isn't a primary focus for Microsoft, the company has secured major contracts, including a ~$22 billion deal with the U.S. Army for specialized HoloLens-based devices (IVAS). Although this program has faced challenges, it emphasizes Microsoft's role in industrial AR. Microsoft's efforts in AR hardware have slowed, with no HoloLens 3 announced yet, but it continues to develop AR through software.

Software Platform and Cloud Edge: Microsoft's strategy is to become the platform for the "enterprise metaverse," while AR marketing agencies are already helping Fortune 1000 companies implement AR solutions that boost training productivity by 40%. It offers Microsoft Mesh, a mixed-reality collaboration platform that integrates with Teams for virtual meetings using holographic avatars. The Azure cloud delivers services for AR developers such as object recognition and spatial anchors, and it supports high-performance computing for AR applications. Microsoft is essentially selling shovels in the AR gold rush—Azure will host a large amount of AR content, and Dynamics 365 Guides (an AR training app) runs on HoloLens for industrial workflows. Additionally, Microsoft's acquisition of Activision Blizzard (expected to close in 2025) could potentially be integrated into AR gaming later, and its Windows and Xbox platforms might support third-party AR devices.

Recent Performance: Microsoft's financial results have been strong, driven by cloud and AI. Its stock rose about 30% over the past year, outperforming the Nasdaq. The market mainly values Microsoft for its AI potential, like Azure OpenAI services, while AR is a smaller aspect. This indicates that AR growth is mostly potential upside for investors. In the coming year, Microsoft's stock may rise due to ongoing AI and cloud expansion; any positive AR news—such as a HoloLens 3 reveal or increased enterprise adoption—would be welcomed. With low expectations for AR in the near term, Microsoft has limited downside related to AR execution—its core business can support the stock as AR quietly develops.

5-Year Outlook: Microsoft is expected to grow earnings by about 15% annually, consistent with its recent growth trend. This will likely double EPS over five years. We estimate roughly a +100% total return by 2030 for MSFT (turning $10k into about $20k). This assumes Microsoft's valuation stays near current levels, which is reasonable given its size and diversity. AR's role could become more important in five years; for example, Microsoft might launch a popular cloud-based AR service or see HoloLens adoption in sectors like education and manufacturing. Even modest success could increase revenue growth by a few percentage points. Compared to other opportunities, Microsoft offers a lower-risk AR investment—it's a diversified giant where AR is just one part of a larger growth story, including AI and cloud. We see Microsoft as a core holding with balanced short- and long-term gains and a meaningful stake in the AR trend through enterprise solutions.

Alphabet/Google (GOOGL) – Software-Centric AR Play

Alphabet (Google) contributes to AR primarily through software, platforms, and its extensive mobile ecosystem, rather than dedicated hardware (for now). Our take on Google's AR positioning:

AR Platform for Android: Google's Android OS powers about 70% of the world's smartphones, giving Google extensive reach to promote AR. Google's ARCore technology is the Android equivalent of Apple's ARKit, enabling advanced AR features on hundreds of millions of Android phones from various manufacturers. Through ARCore and its software libraries, Google has supported apps like Google Lens (visual search using the camera) and AR navigation in Google Maps (users can see arrows and directions overlaid on the real world through their phone camera). This widespread adoption of mobile AR ensures Google will remain a key player as consumers get used to AR services on phones.

Services and Advertising in AR: Google is integrating AR into its main services. For example, Google Search now shows 3D AR models of animals, landmarks, and products that users can place into their real environment using their phone camera. YouTube offers AR features like virtual try-on for beauty product ads. These efforts support Google's advertising business – AR can make ads more interactive, such as trying furniture in your room with AR before buying, a strategy used by leading AR marketing campaigns to significantly boost conversion rates. Although still early, this is a natural extension of Google's dominance in advertising into the AR space. Google's cloud division is also developing AR tools for businesses, including AR training modules and AR-enhanced Google Meet.

Hardware Efforts and R&D: Google's history with AR hardware has been inconsistent. It launched Google Glass in 2013, an early AR headset, but shifted Glass to enterprise use after pushback from consumers. More recently, Google acquired North, a smart glasses startup, in 2020, showing ongoing interest in developing lightweight AR eyewear. However, reports in 2023 indicated that Google moved away from building its own AR glasses, opting instead to provide software (ARCore) and possibly collaborate with hardware manufacturers. It is also investing in AR through "ambient computing"—integrating physical and digital experiences via voice (Assistant) and visual AR. While Google does not currently have a standalone AR device, it's expected to re-enter the market with a product once the technology and market are more developed (likely within 5 years).

Recent Performance: Alphabet's shares have increased approximately 24% over the past year, signaling a recovery from a weak 2022. The company faced concerns about AI competition but has since impressed investors with consistent growth and effective cost management. AR is not a significant short-term driver for Google—its story mainly hinges on the stability of search advertising and advancements in cloud services. However, any signs of future AR hardware, such as Google announcing a new AR headset or major AR features in Android updates, could slightly improve sentiment. Over the next year, we expect Google's stock to perform in line with its earnings growth (low double digits), with little impact from AR.

5-Year Outlook: We expect Alphabet to deliver around +100% total return over five years, roughly aligning with approximately 15% annual EPS growth. This would turn a $10,000 investment into about $20,000 by 2030. AR is one of many growth opportunities for Google—less immediately monetizable than AI or cloud but strategically vital. If AR usage expands significantly, Google could benefit through increased engagement (more visual searches, map usage, etc.) and potentially a new ad revenue stream (AR ads). Its YouTube and Play Store might also generate sales from AR content and apps. In conclusion, Google offers a stable, diversified play on AR's growth, with a dominant platform (Android) ensuring it captures value as AR becomes mainstream. Investors can view Google as a steady growth stock with AR providing upside potential without adding much risk.

NVIDIA (NVDA) – AR's "Picks and Shovels" Supplier

NVIDIA is a semiconductor powerhouse whose products are critical for AR and related fields (VR, AI). It represents a key infrastructure choice for AR's growth. Highlights on NVIDIA:

GPUs and AR/VR Processing: AR applications—especially immersive 3D graphics and computer vision tasks—require immense computing power. NVIDIA's high-performance GPU (graphics processing unit) chips excel at rendering 3D visuals in real time, which is crucial for both VR and AR. For example, advanced AR headsets and VR devices often use GPU-based rendering (either on the device or via a PC/console). NVIDIA's latest GPUs (such as the RTX series) support technologies like foveated rendering and low-latency streaming, which can greatly enhance AR/VR experiences. Furthermore, in cloud-based AR (where heavy graphics are rendered in the cloud and streamed to lightweight glasses), NVIDIA's data center GPUs (e.g., A100, H100) are essential. In summary, the growing use of AR/VR hardware likely increases demand for NVIDIA's chips—either directly in devices or in servers supporting AR cloud services.

AI and the Metaverse Tools: NVIDIA positions itself at the crossroads of AI and the metaverse, including AR. Its Omniverse platform offers a 3D simulation and collaboration environment that companies use to create "digital twins"—virtual models of real-world factories, buildings, and more, viewable in AR. Omniverse operates on NVIDIA GPUs and software, providing comprehensive solutions for developers building AR/VR environments. Additionally, AR devices rely on AI for object recognition, gesture tracking, and other functions, and NVIDIA's leadership in AI chips means it supplies many of the AI models and libraries that power AR, such as hand-tracking algorithms accelerated by NVIDIA hardware. As AR experiences become smarter and more interactive, they will depend heavily on AI—a trend that benefits NVIDIA directly.

Recent Performance: NVIDIA's stock has enjoyed a remarkable rise, mainly driven by the AI boom. Over the past 12 months, NVDA has grown by roughly 67%, and its market cap surpassed $1 trillion in 2025. This surge was fueled by soaring demand for AI GPUs used in training models like ChatGPT. AR has not been the primary focus, but it is part of the broader story of graphics and AI convergence. Notably, NVIDIA's revenues in early 2025 increased by 69% year over year, demonstrating strong growth. In the short term, NVIDIA's valuation remains high, and the stock could face volatility. However, consistent earnings beats—such as from AI chip sales—are likely to sustain strong momentum. Any developments linking NVIDIA explicitly to AR—such as securing major headset designs or launching new AR-specific chips—would strengthen its position. For example, NVIDIA's XR silicon or partnerships to stream AR content from cloud GPUs to devices could emerge, further boosting investor confidence in its AR prospects.

5-Year Outlook: NVIDIA is expected to sustain a higher growth rate than most mega-cap stocks, driven by secular trends in AI, gaming, and the metaverse. Although specific five-year analyst growth estimates vary, around 20% annual revenue growth over several years seems reasonable. We estimate roughly +150% total return over five years (turning $10k into approximately $25k). This assumes NVIDIA's current AI leadership extends into AR, capturing a significant profit share. One risk is that much of NVIDIA's current valuation already reflects substantial growth, so future gains depend on flawless execution and the success of new markets like AR meeting high expectations. On the upside, if AR/VR adoption accelerates—adding tens of millions of new devices by 2030—NVIDIA could surpass our projections, as it provides key components for that growth. In summary, NVIDIA is a high-growth, high-reward stock that benefits indirectly from AR's expansion, offering exposure to its core technology infrastructure.

Qualcomm (QCOM) – Mobile Chipset Provider for AR

Qualcomm is a leading designer of mobile and XR (extended reality) chips, making it a key enabler of AR hardware. Our analysis of Qualcomm:

Snapdragon XR Platform: Qualcomm's Snapdragon system-on-chip (SoC) processors power most standalone AR and VR devices today. Its Snapdragon XR2 chip (used in 1st and 2nd Gen headsets) has been featured in devices like Meta Quest 2 and Quest 3, Microsoft HoloLens 2 (with an adapted Snapdragon 850), and many other AR glasses and VR headsets. Qualcomm offers not just chips but also reference designs to help manufacturers develop AR glasses using its silicon. Importantly, Qualcomm's chips include specialized AR features such as optimized computer vision, spatial mapping, and efficient graphics. As long as AR headsets aim to be untethered (wirelessly operated, like a smartphone), Qualcomm's expertise in low-power mobile processing gives it a strong edge. Essentially, Qualcomm could become for AR devices what it has been for smartphones – the primary silicon provider.

5G and Edge Computing: Another advantage of Qualcomm related to AR is its 5G connectivity. High-bandwidth, low-latency 5G networks can improve AR experiences by moving heavy processing to edge and cloud servers. Qualcomm actively promotes 5G applications for AR, and its modems are likely to be integrated into future AR glasses to maintain constant cloud connection. The company's concept of "XR viewers" (lightweight AR glasses connected to 5G smartphones) also boosts demand for its chips in both phones and glasses. By advancing standards like OpenXR and working with carriers, Qualcomm is shaping the ecosystem for widespread AR.

Recent Performance: Qualcomm's stock performance has been modest compared to others—about a 4% increase over the last 12 months. The company faced challenges in its core smartphone chipset business due to a cyclical downturn in handset sales and Apple's move to develop its own modems. These issues have kept Qualcomm's valuation moderate. However, there are signs of stabilization: Qualcomm's revenues have returned to year-over-year growth (+10% YoY in Q3 2025), and it beat earnings forecasts. In the near term, the stock could rise if the smartphone market improves or if Qualcomm announces major AR wins—such as confirming that Apple's future AR glasses will use Qualcomm chips or forming a partnership with Meta on custom silicon. Qualcomm's exposure to China's smartphone recovery and its dividend yield also support the stock in the short term.

5-Year Outlook: Qualcomm is not expected to grow as quickly as the hyper-growth stocks; analysts project its 5-year earnings CAGR at a modest ~7% annually. We expect around a 50% total return over 5 years (turning $10k into about $15k) for Qualcomm, assuming steady revenue growth and some multiple expansion as markets stabilize. AR could significantly enhance that outlook if it becomes a meaningful revenue stream. For instance, if AR/VR headset volumes reach tens of millions annually by 2030, Qualcomm would likely capture a large portion of those chip sales, establishing a new high-margin growth sector. It also has growth opportunities in auto and IoT, which complement AR. In summary, Qualcomm offers a value-oriented way to gain exposure to AR — it's a profitable, dividend-paying company where AR could provide additional growth. It might not surge like a pure AR company, but it complements an AR portfolio with steady performance and potential upside if AR hardware achieves widespread adoption.

Unity Software (U) – Pure-Play AR/VR Development Platform

Unity is a specialized software company and a pure-play on the growth of AR/VR content. It provides the engine that many AR experiences run on. Key points on Unity:

Dominant Content Engine: Unity's real-time 3D engine is one of the two primary game development platforms worldwide, the other being Unreal Engine. Unity has established a strong presence, especially in mobile and indie development, powering 70% of the top mobile games. Importantly, for AR and VR, Unity is often the preferred engine because of its ease of use and cross-platform capabilities. Developers utilize Unity to create AR applications ranging from games to enterprise training simulations. Notably, Apple partnered with Unity for Vision Pro—Unity announced that developers can easily port Unity-based apps to run on the Vision Pro headset. This endorsement is significant: it means thousands of existing Unity applications, including many VR games and 3D apps, will be part of Apple's AR ecosystem at launch. Unity is also integrated with Meta's platforms and Microsoft's HoloLens. In short, Unity is essentially providing the tools for the AR gold rush, powering AR marketing campaigns that are transforming how brands engage with consumers across social platforms and out-of-home advertising.

Monetization and Services: Besides engine licenses, Unity earns revenue through services like advertising, in-app purchase infrastructure, and enterprise solutions. For AR developers, Unity provides toolkits such as Unity MARS for AR-specific content creation, making it easier to develop AR experiences. As more companies incorporate AR into their marketing or training, Unity benefits from increased software subscriptions. The company is also investing in AI-assisted content creation, which accelerates the development of 3D assets for AR. These initiatives strengthen Unity's position as a comprehensive platform for the "metaverse" economy.

Recent Performance: Unity's stock has been volatile. It saw a sharp decline in 2022–2023, dropping over 80% from its peak at one point, due to slowing growth and significant losses. However, the years 2024–2025 brought a rebound: in the past 12 months, Unity's stock increased approximately 130%. This reflects improved financials—Unity reported positive free cash flow and narrowed operating losses, surprising investors. A recent catalyst was an analyst upgrade citing increased ad spend in mobile games and Unity's growing cash generation. In fact, Unity's free cash flow over the last 12 months is about $308M and continues to grow, offering a clearer path to profitability. In the short term, Unity's share price may be sensitive to tech sentiment and execution; for example, a misstep in pricing strategy hurt it in 2023 when a proposed fee caused backlash. However, ongoing growth in AR/VR development—such as successful adoption of Vision Pro apps built on Unity—would likely drive further stock appreciation.

5-Year Outlook: Unity is a higher-risk, higher-reward stock in AR. Analysts forecast strong growth – S&P Global consensus expects Unity's free cash flow to more than triple by 2030, with revenue increasing at a mid-teens rate or higher. If Unity can sustain around 15–20% annual revenue growth and improve margins, its stock could grow substantially. We project about a 200% return over 5 years (potentially tripling in value, from $10K to $30K), considering the low starting point and the expanding AR market ahead. This assumes Unity remains consistently profitable and captures a significant share of the growing AR development boom – for example, thousands of new AR apps for education, entertainment, and business built on Unity. Risks include competition from Unreal Engine, new market entrants, and the pace of AR adoption itself. But as a pure AR content play, Unity offers exposure to the volume of AR experiences being created – essentially serving as a "tollbooth" on the AR content highway. For investors seeking targeted AR exposure, Unity is an attractive addition, complementing larger tech giants in a diversified portfolio.

Snap Inc. (SNAP) – Social AR and Consumer Engagement

Snap, the parent of Snapchat, is a unique AR play focused on social media and augmented reality for consumers. Analysis of Snap's AR angle:

AR Lenses and User Engagement: Snapchat's main feature beyond ephemeral messaging is its AR Lenses—fun filters and effects that overlay on users' faces or the environment. Snap pioneered this on a large scale; hundreds of millions of users interact with AR Lenses daily, with top social AR marketing campaigns of 2025 demonstrating that strategic Snapchat implementations can deliver a 460% return on ad spend. This has established a strong foundation of AR expertise—its Lens Studio tools enable creators and advertisers to develop AR experiences, and Snap's AR technology (such as advanced face mapping and world scanning with smartphones) is industry-leading. With about 460 million Daily Active Users on Snapchat, Snap has arguably introduced more people to AR than any other company through its playful lenses. Importantly, Snap is moving lenses from simple novelty to practical applications, such as AR try-on for e-commerce (allowing users to virtually try on clothing or makeup) and landmark-based AR experiences in cities.

Spectacles and Future Vision: Snap has been developing its Spectacles—camera sunglasses—for years, and in 2021, it introduced an AR version of Spectacles (distributed to developers, not sold to the public). While still experimental, these AR glasses showcase Snap's dedication to a future where AR is worn effortlessly. Snap's long-term vision is that "the camera is the new keyboard," meaning people will use the camera (and AR) to communicate and compute. This aligns with AR's potential, and Snap is positioning itself to lead when consumer AR hardware becomes practical. Its early advantage in AR content and its young user base could help Snap carve out a niche that even larger companies might find difficult to imitate culturally.

Recent Performance: Snap's stock has faced a tough journey – after reaching a peak in 2021, it dropped over 80% amid slowing revenue growth and significant losses. Over the past year, however, Snap's share price has recovered about 20%. The company returned to modest revenue growth (e.g., +9% YoY in Q2 2025) after a flat 2024, and made progress in cutting costs. Still, Snap is mostly breaking even or losing money and faces stiff competition from larger platforms. In the short term, Snap's stock performance will depend on advertising revenue trends and user growth. AR can play a supporting role – for example, new AR ad formats or partnerships (such as Snap working with Amazon on AR shopping) could attract investors if they start contributing significantly to sales. It's important to note that AR lenses, while popular, currently account for a small portion of Snap's overall revenue, as monetization is still in the early stages. Any progress in monetizing AR engagement effectively (through sponsored lenses, AR commerce, etc.) could serve as a catalyst.

5-Year Outlook: Snap is a speculative investment within this group. If it succeeds, it could deliver the highest percentage returns; if not, it might stagnate or decline. We estimate an optimistic scenario of about +150% over 5 years ($10k → $25k), assuming Snap manages to reignite growth—perhaps reaching low double-digit revenue growth by 2026—and significantly boosts profitability. AR is central to this thesis: Snap's differentiation lies in its AR platform, so monetizing it (through ads and possibly subscription features) is crucial. Analysts expect Snap's EBITDA to grow by 2026 as cost reductions and revenue initiatives (including AR products) take effect. In a bullish scenario, by 2030, Snap could also become an acquisition target for a larger tech company interested in AR and a young user base. In a bearish scenario, user engagement might shift to competitors, and Snap's AR efforts could fail to overcome its financial challenges. Therefore, we see Snap as a high-risk, high-reward addition to an AR portfolio—it provides exposure to the consumer AR engagement segment (where time spent on AR is highest), balancing the enterprise and hardware focus of other investments. For investors confident in AR transforming social media and advertising over the long term, Snap presents a unique but speculative opportunity.

Conclusion and Investment Considerations

Augmented reality is set to become essential within the next five years, moving beyond its current experimental phase. The companies analyzed—including device manufacturers, chip providers, software developers, and social media platforms—each claim a strategic position in this emerging ecosystem. An $80,000 portfolio that invests $10,000 evenly across Meta, Apple, Microsoft, Alphabet, NVIDIA, Qualcomm, Unity, and Snap would be well-placed to benefit from AR growth. This mix offers a balance between stability—comprising large, trillion-dollar companies—and targeted AR exposure, like Unity and Snap, aiming to maximize both short-term profits and long-term opportunities.

In the near term, we expect continued outperformance from names like Meta and NVIDIA, which are gaining momentum from related themes such as the metaverse and AI, even as they expand their AR capabilities. Apple and Microsoft serve as resilient core holdings with upcoming AR catalysts that could surprise to the upside, like consumer enthusiasm around Vision Pro or new enterprise AR contracts. Google and Qualcomm provide more value-oriented profiles—solid companies where AR could generate additional growth without being critical to the overall thesis. On the more aggressive side, Unity and Snap offer multibagger potential tied directly to AR adoption, though with higher volatility; position sizing and risk tolerance should be adjusted accordingly.

It is important to monitor key developments that could influence these projections: the pace of AR hardware adoption (sales of headsets and smart glasses), the progress of AR content and breakthrough applications, successful enterprise AR implementations, competitive moves (such as if a new player like a startup or a Chinese tech giant makes advances in AR), and macroeconomic factors affecting overall tech valuations. Currently, Wall Street consensus increasingly recognizes AR's potential – top AR stocks are often listed among "best tech investments for the next 5 years." For example, Meta, Apple, Microsoft, NVIDIA, and others are labeled as "top metaverse/AR picks" by analysts, considering the projected $62+ billion AR market by 2029.

In conclusion, AR and AR-adjacent stocks in 2025 offer an appealing investment opportunity. Our strategic analysis suggests that a diversified approach focused on global leaders with major AR projects should yield strong returns. With an expected portfolio return in the high double digits to low triple digits (%) over five years, investors could potentially double their money or more by 2030 through these AR opportunities while also benefiting from short-term rallies as technological milestones are reached. The advice is to maintain balanced exposure: take advantage of short-term gains driven by hype and product launches, but, more importantly, hold on to realize long-term value as AR becomes a widespread computing paradigm. Although the journey may involve volatility, the goal—a world where AR is integrated into everyday life and these companies profit from it—seems increasingly attainable, especially since current AR marketing campaigns already demonstrate measurable business impact and consumer adoption.

TALK TO A PRO

We're here to bring your brand to life!

Stay Connected with BrandXR

Create Augmented Reality for Free!

Create, Publish, and Measure 3D Augmented Reality Experiences Without Having to Code.