Is AR Cheaper Than VR? Exploring the Cost Differences and Value

The digital age has ushered in revolutionary technologies that have transformed how we interact with the world around us. Among these innovations, Augmented Reality (AR) and Virtual Reality (VR) stand out, offering immersive experiences that blur the lines between the digital and the physical realms. As these technologies become more accessible, one question often arises: Is AR cheaper than VR? This article delves into the financial aspects of AR and VR, offering insights into the cost dynamics and the value they bring to users and industries alike.

Understanding AR and VR

At the heart of our discussion lies the fundamental understanding of what AR and VR entail. Augmented Reality enriches our perception of the real world by overlaying digital information onto our physical environment, enhancing our experiences without disconnecting us from our surroundings. Virtual Reality, on the other hand, transports us to entirely digital environments, offering an escape to virtual worlds that are limited only by imagination. This distinction is crucial as it influences the technology, applications, and, importantly, the cost structures of AR and VR.

Cost Analysis

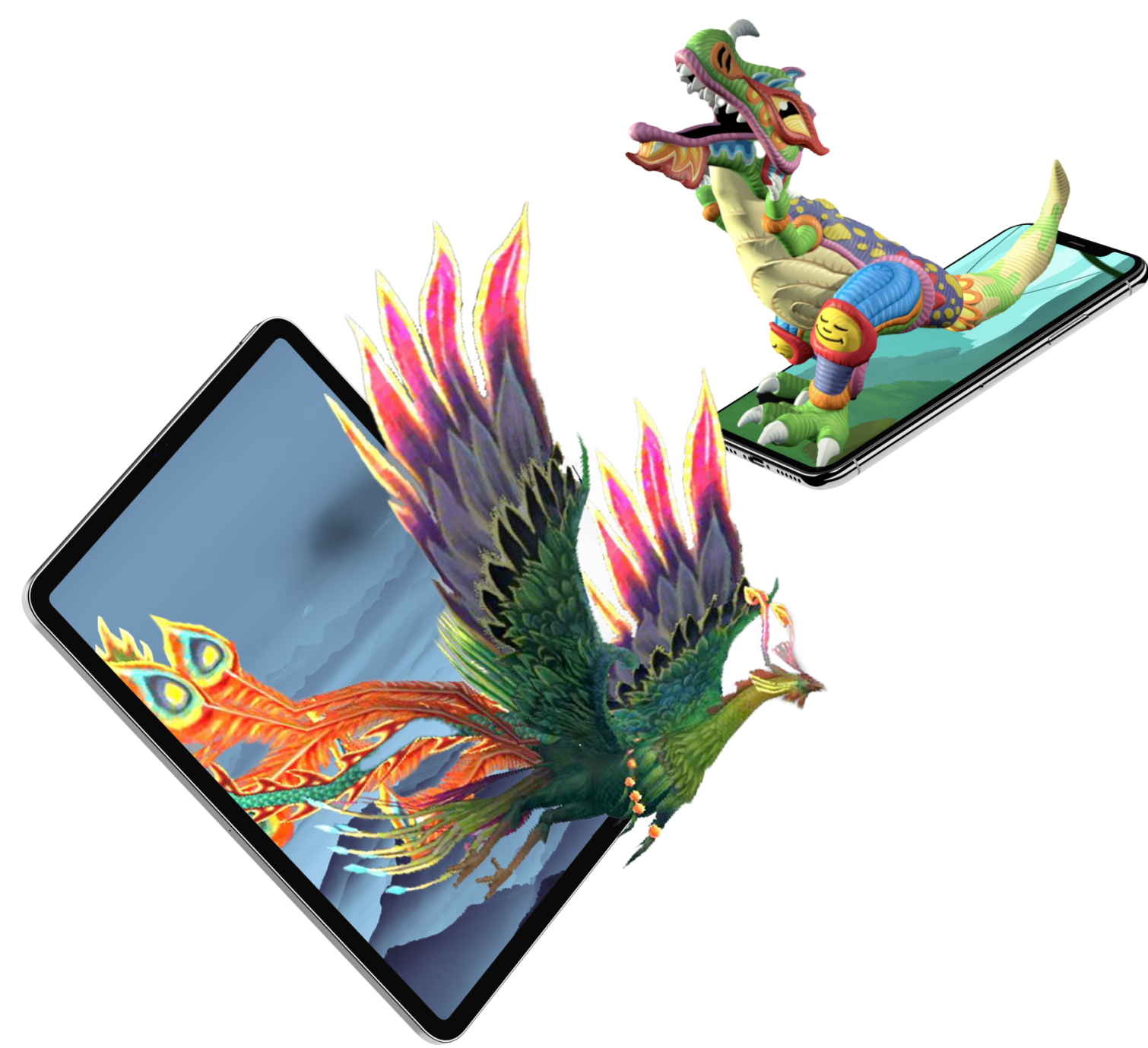

When considering whether AR is cheaper than VR, we must examine both hardware and software aspects. VR typically requires specialized headsets, controllers, and sometimes additional sensors to create immersive environments. These hardware components can be costly, making VR setups a significant investment. AR, in many cases, leverages existing devices like smartphones and tablets, with apps that utilize the device's camera and sensors to overlay digital elements onto the real world, potentially making AR a more cost-effective option for consumers and businesses.

Accessibility and Usage

Accessibility plays a pivotal role in the cost-effectiveness of AR and VR. AR's ability to function on widely owned devices like smartphones and tablets makes it readily accessible to a vast audience with minimal additional cost. VR's need for specific hardware may limit its accessibility and increase the overall cost for users who do not already own the necessary equipment.

The Development Perspective

From a development standpoint, creating content for VR can be more resource-intensive due to the need for comprehensive digital environments. AR development, while not without its challenges, often requires less extensive digital asset creation since it incorporates the real world into the experience. This difference can translate into lower development costs for AR applications, making it an attractive option for developers working with limited budgets.

Content Availability

The availability of content also influences the cost and value proposition of AR and VR. While VR offers deeply immersive experiences, the development and acquisition of high-quality VR content can be expensive. AR content, being more integrated with the real world, may have lower production costs, potentially offering a wider range of applications at a lower price point.

Future Projections

Looking ahead, advancements in technology and increased adoption are likely to impact the costs associated with AR and VR. As hardware becomes more sophisticated and production scales up, prices may decrease, making both AR and VR more accessible. However, AR's reliance on existing devices could maintain its position as the more cost-effective option in the near future.

Real-World Applications

Exploring the real-world applications of AR and VR sheds light on their value beyond cost. AR has found applications in education, retail, and navigation, enhancing real-world interactions without significant hardware investments. VR's immersive capabilities have revolutionized gaming, training, and simulation, offering experiences that justify the investment for many users.

Consumer Preferences

Market demand and consumer preferences significantly influence the cost dynamics of AR and VR. The widespread availability of smartphones and the growing interest in AR applications for everyday use suggest a market leaning towards cost-effective, accessible technology. VR, while perhaps more niche due to its hardware requirements, continues to attract enthusiasts willing to invest in high-quality immersive experiences.

Investment in AR and VR

The investment landscape for AR and VR provides insight into industry beliefs regarding their future. Significant investments in AR technologies by major tech companies highlight the potential for widespread application and adoption, suggesting a belief in AR's long-term value proposition. VR also continues to receive substantial investment, particularly in sectors like gaming and training, indicating confidence in its continued growth and development.

Emerging Technologies

New technological advances could shift the cost balance between AR and VR. Developments in display technology, sensory feedback, and software optimization may reduce production costs and enhance user experiences, potentially altering the current cost dynamics.

Pros and Cons

Evaluating the pros and cons of AR and VR from a cost perspective reveals a complex picture. AR offers accessibility and versatility with potentially lower upfront costs, making it appealing for widespread use. VR, with its higher initial investment, provides unparalleled immersive experiences, offering value that may justify the cost for dedicated users.

FAQs

How do the initial costs of AR and VR compare?

Can AR and VR technologies become more affordable in the future?

What are the main factors driving the cost of AR and VR development?

Are there industries where the investment in VR is more justified than in AR?

How do consumer preferences affect the cost and development of AR and VR?

What role do emerging technologies play in the cost dynamics of AR and VR?

Conclusion

The question of whether AR is cheaper than VR cannot be answered simply. While AR often presents a more accessible and cost-effective entry point, VR offers immersive experiences that can justify its higher cost for many users. The future of AR and VR costs will likely be shaped by technological advancements, consumer preferences, and real-world applications that expand the boundaries of what is possible in digital experiences. As we continue to explore and innovate, the value of AR and VR extends far beyond their initial cost, offering transformative experiences that redefine our interaction with technology and the world around us.

TALK TO A PRO

We're here to bring your brand to life!

Stay Connected with BrandXR

Create Augmented Reality for Free!

Create, Publish, and Measure 3D Augmented Reality Experiences Without Having to Code.