Phygital Retail Experiences – Blending Physical and Digital In-store Experiences

The merging of physical and digital retail experiences through augmented reality has reached a pivotal point, with Fortune 1000 companies reporting 20-40% increases in conversion rates and the AR retail market growing from $2.3 billion in 2024 to an estimated $6.7 billion by 2030. This thorough analysis shows that early adopters of AR storefronts, murals, billboards, and mirrors are enhancing customer engagement and fundamentally changing retail profitability. With 91.75% of Generation Z showing strong interest in AR shopping experiences and 61% of consumers preferring stores with AR features, the chance to lead the market is quickly slipping away.

The evidence is clear: Sephora's AR mirrors result in a 31% boost in sales and 90% higher conversion rates, while furniture retailers using AR visualization see a 22-40% reduction in return rates. These are not just experimental numbers—they are proven business outcomes from cosmetics, fashion, furniture, and out-of-home advertising applications. The main message is this: organizations that excel in phygital experiences over the next 18 months will gain significant competitive advantages as consumer expectations increase around interactive, immersive shopping.

Quantified market opportunity validates strategic urgency

The phygital retail market is one of modern commerce's most exciting growth stories. The global AR shopping market is projected to reach $54.7 billion by 2033, with a remarkable 29.9% compound annual growth rate from $4.0 billion in 2023. This growth is driven by both technological advances and fundamental shifts in consumer behavior, particularly among digital-native demographics who will have purchasing power over the next decade.

Consumer demand has hit a turning point: 91.75% of Generation Z shoppers actively seek AR-enabled experiences, and 65% of all consumers now prefer phygital shopping over traditional methods. Perhaps most notably, 40% of consumers are willing to pay premium prices for products they can experience through AR, demonstrating that this technology increases engagement and revenue.

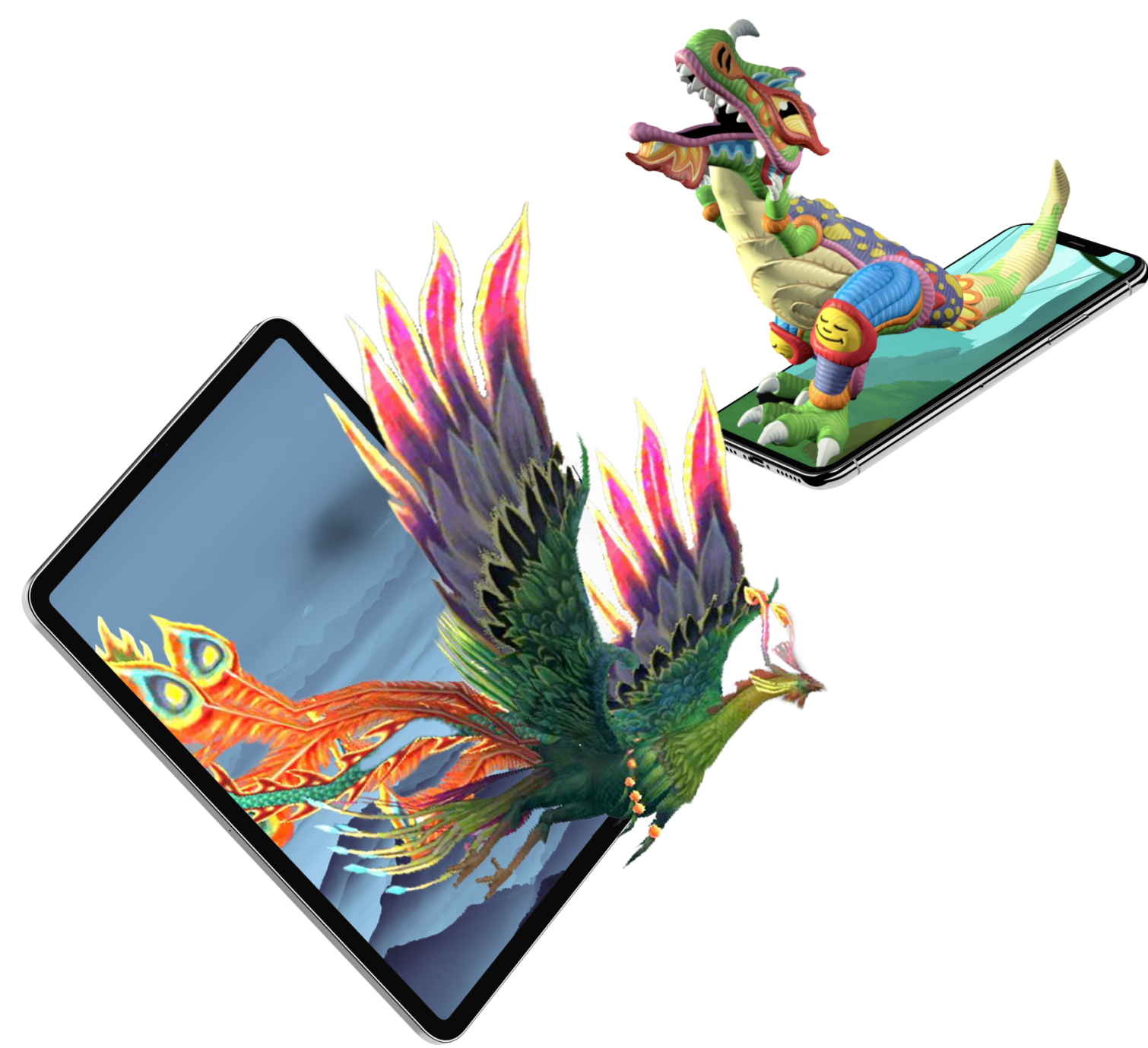

The mobile AR retail market alone is expected to hit $8.6 billion by 2025, with 1.73 billion AR-enabled devices worldwide by the end of 2024. This infrastructure removes previous barriers to AR adoption, allowing mass-market consumers to access sophisticated retail experiences via existing smartphone hardware. BrandXR's detailed analysis of AR in retail emphasizes this transformation across various industry sectors.

Enterprise adoption is quickly rising: 35% of business leaders have adopted AR/VR technology in at least one business unit, with 13% implementing it across multiple divisions. Among Fortune 500 retailers, 70% actively integrate phygital technologies, while 57% plan to increase software spending in 2024 specifically for marketing and IT initiatives supporting these experiences.

AR retail applications deliver measurable business transformation

AR mirrors bring digital experiences to beauty and fashion retail

The beauty industry is leading in AR retail adoption, with documented ROI exceeding 300% across major implementations. Sephora's AR mirror deployment experienced a 31% rise in sales from trial users, while conversion rates increased by 90% for customers using AR try-on features compared to traditional shoppers. These results demonstrate consistent performance over multiple quarters, not just short-term campaign boosts.

L'Oréal's comprehensive AR strategy demonstrates enterprise-wide success. Their ModiFace technology integration across over 50 product lines results in 2.5 times higher conversion rates for lipstick sales, while Estée Lauder Companies reports a 30% increase in basket size through AI-powered AR mirrors. The technology's influence extends beyond individual transactions—stores with AR mirrors see five times longer customer dwell time, creating more opportunities for cross-selling and brand education.

Implementation details reveal scalable success factors: L'Oréal's "Magic Mirrors" in Shanghai, Wuhan, and Changsha boutiques combine real-time AR try-on features with direct e-commerce shopping. Customers can virtually try products, receive personalized recommendations based on facial analysis, and make purchases smoothly within the AR experience. This strategy has resulted in double-digit sales growth across Asian markets and is now expanding to European and North American locations.

The technology infrastructure behind these results includes 3D photo-realistic rendering, real-time facial tracking, and integration with customer loyalty programs for personalized product recommendations. Critical success factors include professional-grade lighting systems, high-resolution displays, and seamless integration with point-of-sale systems that enable immediate purchase completion.

Fashion retailers implementing AR mirrors achieve similar results with

90% higher

conversion rates than traditional fitting room experiences.

AR storefronts transform window shopping into interactive experiences

AR storefronts represent the evolution of traditional retail displays into interactive, engaging tools for attracting customers. Research shows 11 times higher engagement rates for AR-enabled storefronts than static displays, and 70% of consumers take immediate action after engaging with AR outdoor advertising.

The technology transforms passive window shopping into active product exploration. Customers can virtually try on clothing, view furniture in their homes, or access detailed product information through smartphone interactions with storefront displays. Implementation costs range from $50,000 to $200,000 for complete storefront AR systems, with ROI typically realized within 6-12 months through increased foot traffic and sales. Analysis of AR mirrors versus traditional displays shows three times higher foot traffic for AR-enabled storefronts.

Successful implementations connect multiple touchpoints: QR codes enable instant mobile engagement, while computer vision technology recognizes customer interactions and adjusts display content accordingly. Social sharing capabilities expand reach, with customers often posting AR experiences to social media platforms, creating organic marketing value similar to traditional advertising spend.

AR billboards amplify out-of-home advertising effectiveness

The out-of-home advertising industry has embraced AR billboard technology to increase engagement with traditional billboards. AR billboards deliver a $6 return for each $1 spent, and incorporating AR features into existing billboard campaigns boosts ROI by 316% compared to static options.

Nike's AR billboard campaigns demonstrate the potential of technology for brand storytelling. Their 3D billboard projections in Tokyo's Shinjuku Station and other global locations feature floating product visuals that customers can interact with using smartphones. The Air Max Day campaign with floating shoebox animations saw a 300% increase in engagement time compared to traditional billboard advertisements.

Strategic implementation depends on high-traffic locations, robust mobile internet infrastructure, and social media integration to boost viral content. Campaign budgets generally range from $100,000 to $500,000, with success evaluated through engagement rates, social media mentions, and store traffic. AR murals in retail settings offer similar engagement advantages, leading to a 40% rise in store visits among younger audiences.

AR furniture visualization eliminates purchase uncertainty

The furniture industry has achieved remarkable results with AR implementation, mainly by addressing the key challenge of visualizing large products in personal spaces. IKEA's AR Place app demonstrates 98% accuracy in product placement using LiDAR technology, while Wayfair reports 22-40% fewer return rates for customers who use AR visualization features.

Wayfair's comprehensive AR strategy includes "View in Room 3D" functionality that lets customers simultaneously place multiple pieces of furniture in their homes. The technology offers real-time lighting calculations, accurate shadow rendering, and body occlusion capabilities, enabling natural interaction with virtual products. 63.4% of Wayfair's orders now originate from mobile devices, with AR features playing a significant role in this growth in mobile commerce.

The business impact extends beyond individual transactions.

Furniture retailers using AR report 38%

of

customers engaging with immersive experiences before buying, and

return rates decrease by

22-40% for AR-assisted purchases. These figures directly contribute to improved profit margins and greater customer satisfaction.

Platform analysis reveals strategic implementation pathways

WebAR platforms enable broad consumer reach

8th Wall has become the leading WebAR platform for retail, supporting over 5 billion devices without requiring app downloads. Their proven success includes Big W's Minecraft campaign, which achieved a 250% sales increase, and Bloomingdale's AR catalog, which boosted conversion rates by 22%. The platform's browser-based approach eliminates barriers that have traditionally limited AR adoption.

Snap AR demonstrates social commerce leadership with a 94% higher conversion rate for AR-enabled shopping experiences. Sephora's Saudi Arabian AR voucher campaign captured 5% of total Ramadan sales via Snapchat's platform, while Zenni Optical reported a 42% increase in return on ad spend using AR try-on features. The platform's over 375,000 creators generate more than 4 trillion annual lens views, providing unmatched reach for retail campaigns.

Specialized platforms deliver category-specific advantages

Perfect Corp leads in beauty AR apps with 770 million downloads and partnerships with over 600 beauty brands. Their YouCam technology enables users to spend 2.7 times more on beauty products, resulting in 10-44% growth in basket size after adoption. The platform's 99.58% service availability ensures reliable customer experiences during busy periods. Research on beauty brand AR adoption confirms these performance metrics across various retail environments.

Enterprise platforms support complex integrations

Microsoft HoloLens and Magic Leap focus on enterprise training and visualization applications, with Lowe's adopting digital twin technology for inventory management and customer support. Although consumer use remains limited due to hardware costs ($3,000-$5,000 per device), these platforms offer advanced features for staff training and complex product demonstrations.

Choosing a strategic platform depends on specific use cases: WebAR solutions like 8th Wall target broad consumer audiences, specialized platforms like Perfect Corp excel in category-specific applications, while enterprise solutions offer advanced features for high-value customer interactions.

Implementation roadmap balances speed with scalability

Phase 1 foundation building requires strategic focus

Successful AR implementations begin with careful planning and clear success criteria. The first three months should focus on evaluating infrastructure, selecting vendors, and creating a pilot program. Budget ranges of $50,000-$150,000 support proof-of-concept work while minimizing risk.

Critical activities include evaluating technology vendors, emphasizing platforms that demonstrate proven retail results rather than general-purpose solutions. Forming cross-functional teams ensures alignment among IT, marketing, operations, and customer service departments. Most importantly, establishing clear ROI baselines and measurement frameworks enables accurate assessment of AR's impact on business outcomes.

Phase 2 pilot development delivers initial results

Months 4-8 focus on implementing the pilot program with 3-5 bestselling products to simplify complexity while maximizing learning opportunities. Budget needs increase to $200,000-$500,000, covering development costs for professional-grade AR experiences and staff training programs.

Success criteria include functional AR experiences that meet quality standards, positive customer feedback with satisfaction rates over 70%, and measurable engagement metrics indicating customer interest. Controlled testing with focus groups provides insights into customer behavior and preferences to guide full-scale rollout strategies.

Phase 3 limited rollout validates scalability

Months 9-12 expand AR capabilities to 10-20% of product catalogs in select markets. As deployment expands, investment increases to $300,000-$750,000, requiring additional infrastructure and support resources. Aim for 15% increases in conversion rates and 20% reductions in return rates, with positive ROI indicators confirming the technology's business impact.

Staff training programs become essential during this phase, as customer-facing employees require comprehensive education on AR features and troubleshooting methods. Customer education campaigns support adoption while establishing realistic expectations for new technology experiences.

Phase 4 full implementation achieves competitive advantage

Months 13-18 achieve comprehensive AR deployment across all product ranges and sales channels. Investment needs range from $500,000 to $1,500,000 but lead to transformational business outcomes, including a 25% increase in customer engagement and measurable revenue growth.

Implementing advanced features involves AI-powered personalization, social sharing capabilities, and cross-platform integration.

Success metrics target a

25% increase in customer engagement and clear revenue attribution to AR experiences, confirming the technology's role in business growth.

Future trends reshape retail experience expectations

2025-2027 technology roadmap accelerates capabilities

The next 24 months will shape AR retail leadership as key technologies mature. WebAR adoption will eliminate app download barriers, enabling instant browser-based access to AR experiences. Deployment of 5G infrastructure will support advanced real-time rendering and cloud processing, enhancing AR quality while reducing device requirements.

AI-powered personalization integration is the next step in AR retail. Studies show a 17% increase in purchase intent when AR experiences are tailored to individual customer preferences. Cross-platform integration will smooth transitions between mobile, in-store, and online AR experiences, creating cohesive customer journeys that boost engagement and conversion opportunities.

Consumer behavior evolution demands strategic adaptation

Generation Z's leadership in consumer spending fuels urgent demand for AR-enabled retail experiences. Gen Z's spending growth is twice as fast as earlier generations, and this group is expected to surpass baby boomer spending worldwide by 2029. 84% of Gen Z consumers prefer technology-driven shopping experiences, making AR capabilities essential for reaching this market segment.

Social commerce integration is becoming increasingly important as the social commerce market approaches $3 trillion by 2026. AR experiences that support social sharing, collaborative shopping, and influencer participation will attract significant portions of this growing market.

Regulatory framework development requires proactive compliance

Data privacy laws will increasingly affect AR retail implementations as governments create specific biometric and spatial data collection frameworks. GDPR compliance for AR experiences requires clear consent protocols, data minimization strategies, and open communication about data use.

As consumers become more aware of data protection, competitive advantage stems from privacy leadership. Organizations implementing privacy-by-design AR architectures and going beyond minimum compliance will differentiate themselves in the market and build customer trust.

Strategic recommendations optimize competitive positioning

Immediate actions capture first-mover advantages

Fortune 1000 marketing leaders should concentrate on developing AR strategies within the next 90 days to leverage rapidly closing competitive opportunities. WebAR implementations should be prioritized over app-based solutions to maximize customer engagement and minimize adoption barriers.

Pilot program launches should focus on top-performing product categories and proven AR applications. Beauty and cosmetics brands should prioritize AR mirrors, furniture retailers should adopt AR visualization, and fashion brands should implement AR try-on features. Budget allocations of $100,000-$300,000 enable meaningful pilot programs with measurable business results.

Strategic partnerships accelerate implementation

Technology vendor partnerships should prioritize platforms with proven retail success over general-purpose solutions. 8th Wall for WebAR capabilities, Perfect Corp for beauty applications, and Snap AR for social commerce integration are established platforms with measurable ROI. AR mural implementations provide additional opportunities for out-of-home advertising integrated with retail experiences.

Creating an innovation lab enables ongoing testing of new AR capabilities while building internal expertise. University partnerships provide access to top research and development talent, and startup collaborations offer opportunities to pilot innovative solutions before they become mainstream.

Long-term vision positions for market leadership

Creating a comprehensive AR ecosystem should be fully implemented across all customer touchpoints by 2027. Investing in AI-powered personalization will distinguish leaders from followers as technology advances and customer expectations evolve.

Thought leadership development through industry speaking engagements, content creation, and sharing best practices enhances organizational credibility while attracting partnership opportunities.

Employee

training

programs improve internal skills that support ongoing AR innovation and execution.

Conclusion

The phygital retail revolution signifies more than technology—it represents a fundamental shift in how consumers discover, evaluate, and purchase products. Companies that successfully incorporate AR within the next 18 months will gain competitive advantages that will grow over time as customer expectations increasingly emphasize interactive, immersive shopping experiences.

The evidence strongly supports taking immediate action: 31% sales growth, 90% higher conversion rates, and 22-40% reductions in return rates demonstrate that AR retail applications deliver tangible business results. The strategic need is clear, with 91.75% of Generation Z demanding AR-enabled shopping experiences and the AR retail market growing at 29.9% annually.

Success relies on balancing innovation with disciplined execution. The most effective implementations combine proven technologies with clear business goals, comprehensive staff training, and robust measurement frameworks. Investing $500,000 to $1,500,000 over 18 months can generate a 300-600% ROI through higher conversions, fewer returns, and increased customer loyalty.

The window to become a leader in AR retail is rapidly closing. Consumer expectations are rising, technology platforms are progressing, and competitive edges are strengthening. Organizations that act swiftly now will shape the future of retail experiences for the next decade, while those that hesitate will follow instead of lead in the phygital retail revolution.

The question isn't whether AR will revolutionize retail—that transformation is already underway. The real question is which organizations will lead that change and secure the significant competitive advantages as first movers in this critical market shift.

TALK TO A PRO

We're here to bring your brand to life!

Stay Connected with BrandXR

Create Augmented Reality for Free!

Create, Publish, and Measure 3D Augmented Reality Experiences Without Having to Code.