Your Smartphone Is Broadcasting Marketing Data — Here’s How

Smartphones have transformed the way marketing data is gathered and shared, reshaping the future of digital advertising and the interaction between technology firms, data brokers, and consumers. With over 6.8 billion smartphone users worldwide, mobile phones have become a key source of collecting user data, enabling companies to provide more personalized marketing experiences. But how exactly do smartphones transmit marketing data? Let's dissect the process, from collecting data through mobile apps to how that data is sold or shared with third parties.

1. Mobile Apps and Data Collection

One of the most significant ways smartphones broadcast marketing data is through mobile apps. Many apps collect various types of user data, requiring permissions that grant them access to personal information such as location, contacts, browsing habits, and more. For example, when a user installs a weather app, it may request access to location data to provide accurate weather updates. However, in addition to this primary function, the app may share this location data with third-party advertisers or brokers for targeted marketing.

This data is invaluable for advertisers because it offers insights into user behavior, preferences, and daily routines. The personal information collected by mobile apps can include location data, device information, browsing habits, app usage, and in some cases, even microphone recordings or access to the user’s camera.

Key Data Collected:

- Location-based data (where users are, how often they visit certain places)

- Usage patterns (which apps are being used and for how long)

- In-app behaviors (purchases, content interaction)

2. Digital Advertising and Data Brokers

Once collected, user data is often shared or sold to data brokers, companies that specialize in collecting and reselling data. In the United States, these brokers compile detailed profiles on smartphone users based on the data collected from apps, mobile devices, and other sources and sell this information to advertisers. With these profiles, advertisers can fine-tune their digital ad strategies to target users more effectively based on their behaviors and preferences.

For instance, a data broker collecting location data from multiple apps might deduce that a user frequently visits gyms and health food stores. This profile can then be sold to health-related companies, which can serve targeted ads to that individual through social media platforms, display ads, or mobile apps.

Key Entities Involved:

- Data Brokers: Resell aggregated user data to advertisers

- Advertisers: Purchase user data to target ads

- Tech Companies: Provide platforms (like Google and Facebook) that serve ads based on user data

3. Target Audiences and Personalized Marketing

Marketers can identify target audiences by analyzing the data collected from mobile devices based on specific behaviors, demographics, and preferences. For example, location-based marketing is particularly powerful because it allows advertisers to serve ads to users in a specific geographic area or who have recently visited a particular location. If a smartphone detects a user near a retail store, advertisers can deliver push notifications or personalized offers in real-time to encourage purchases.

Furthermore, smartphone usage patterns provide insights into the products or services a person is likely to buy. For example, if users frequently browse e-commerce apps for fashion items, they will likely see ads related to clothing brands or fashion sales. These campaigns' effectiveness lies in reaching users at the right time, in the right place, and with the right message.

Example:

A restaurant chain may use location data to target users who frequently live close to its outlets, sending them special discounts during lunch hours. Similarly, mobile apps that track fitness activity may collect user data to serve personalized ads for fitness equipment or supplements.

4. Business Models Behind Data Collection

Collecting and broadcasting marketing data from smartphones is central to many business models in today’s digital economy. Free-to-use mobile apps, for instance, are often supported by ad revenue generated from the data they collect. By gathering user data, these apps can provide advertisers with highly specific targeting options, making the advertising space more valuable.

Selling data to third-party advertisers is a critical revenue stream for many app developers. In some cases, the business model revolves entirely around data collection rather than the app's core functionality. Users, often unaware of the extent to which their data is being harvested, exchange their personal information for access to free apps or services.

Key Business Model:

- Freemium Model: Apps offer free services but collect and sell user data to generate revenue

- Ad-Supported Apps: Use user data to serve targeted ads, thus generating revenue for both app developers and advertisers

5. Legal and Ethical Considerations

While broadcasting marketing data provides significant value for advertisers and tech companies, it raises privacy concerns for smartphone users. Regulations like GDPR in Europe and CCPA in California have aimed to give users more control over their data, requiring apps to be more transparent about their data collection practices and giving users the option to opt out of certain types of data sharing.

However, despite these regulations, selling data to third parties remains common. Users must often navigate complicated consent forms or privacy policies, which may obscure the extent to which their data is being used for marketing purposes.

Conclusion

Smartphones have become essential tools for gathering and sharing marketing data via mobile apps and partnerships with data brokers. As smartphone usage continues to rise, so does the complexity of digital advertising, which uses personal data to deliver highly targeted marketing messages to users.

This not only influences the business models of many tech companies but also raises important ethical and legal questions about data privacy and consumer rights in the era of widespread mobile technology. By understanding how smartphones gather and share data, users can make more informed decisions about their privacy. Similarly, marketers can effectively use this technology to connect with their target audiences.

TALK TO A PRO

We're here to bring your brand to life!

Stay Connected with BrandXR

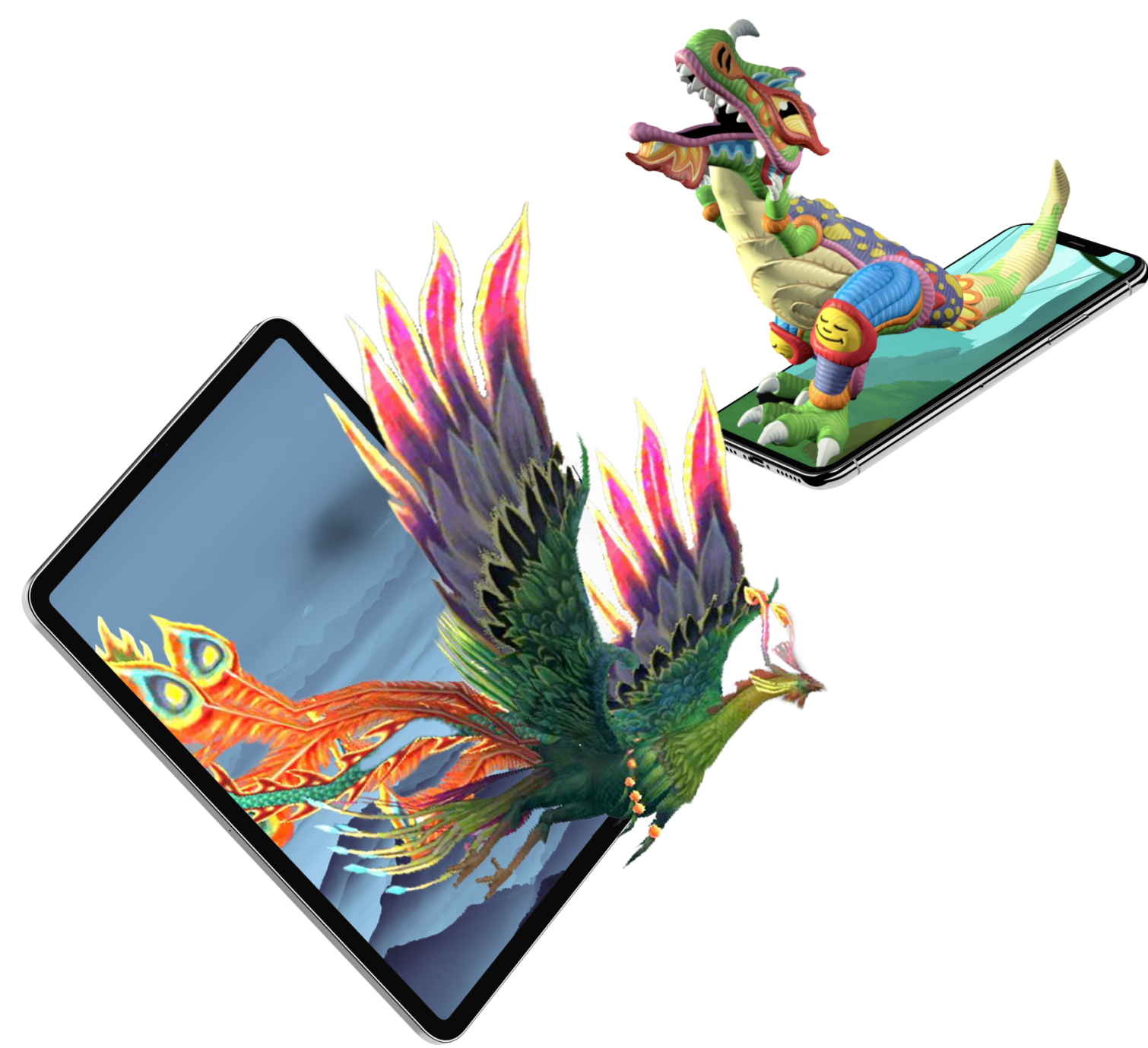

Create Augmented Reality for Free!

Create, Publish, and Measure 3D Augmented Reality Experiences Without Having to Code.