Augmented Reality in Finance: How to Make Money Using Augmented Reality

1. Understanding Augmented Reality

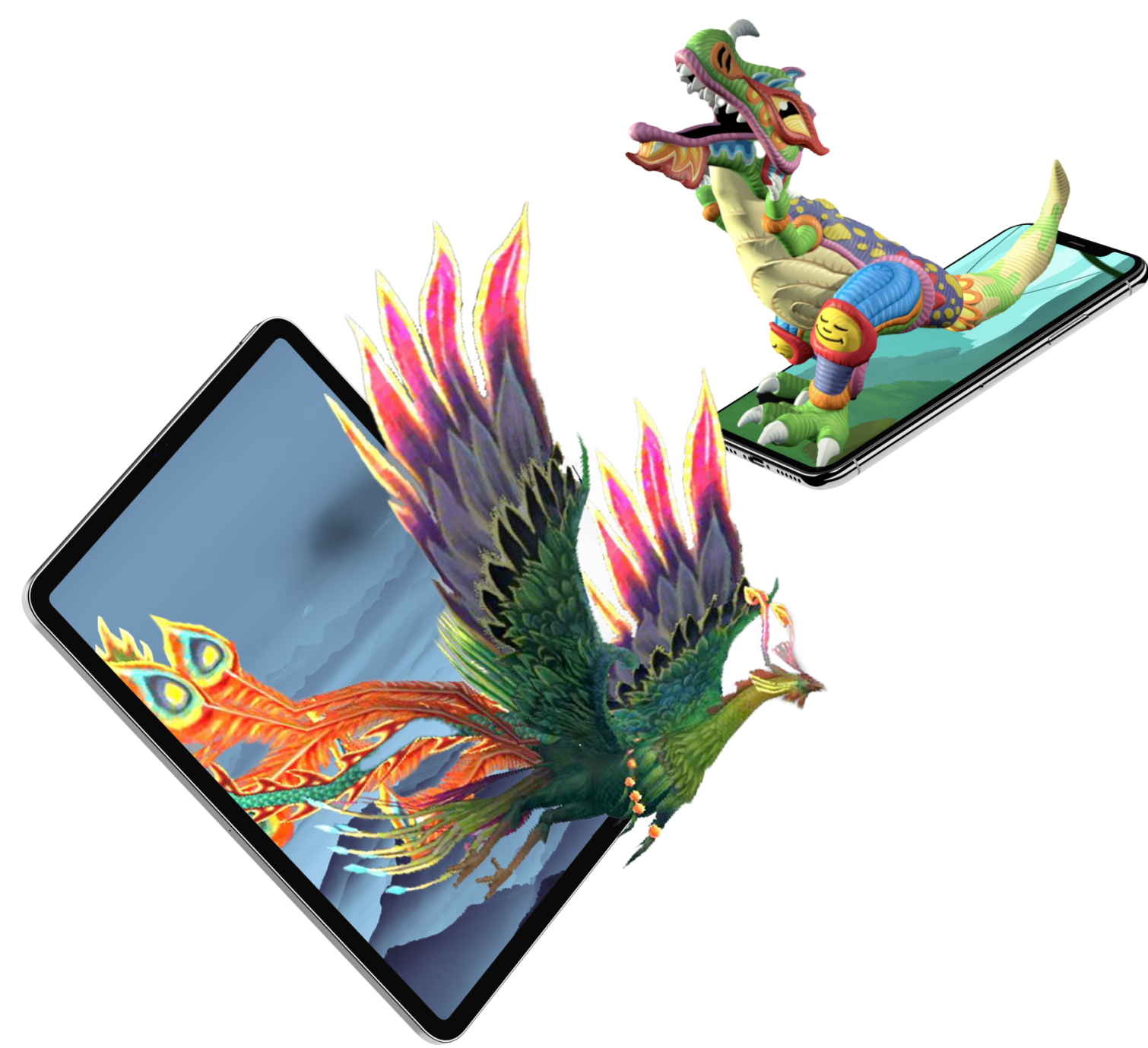

Before diving into the lucrative prospects of augmented reality in finance, it’s important to understand what AR really entails. Augmented reality overlays digital elements (such as images, videos, or interactive content) onto the physical world, enhancing the user’s real-world environment in real time. Unlike virtual reality (VR), which immerses users in a completely virtual space, AR seamlessly merges digital information with the physical environment.

A simple example of AR is how smartphone apps overlay directions or user-generated digital objects onto a phone’s camera view. On a more advanced level, head-mounted displays or smart glasses can overlay complex data and visuals onto a user’s field of view. This ability to bridge digital and physical worlds in real time is a game-changer for many industries, including finance.

2. Why Augmented Reality Matters in Finance

Enhanced Data Visualization

Finance is fundamentally data-driven. Traders, analysts, and wealth managers handle massive volumes of data daily, ranging from financial statements to predictive analytics and real-time price feeds. AR offers a dynamic way to visualize these data sets. Instead of flipping through static spreadsheets, you can use immersive 3D models and interactive overlays. This heightened level of engagement makes it easier to spot patterns, correlations, and opportunities that might otherwise be missed.

Improved Client Engagement

Client relationships lie at the heart of financial services. Whether you work for a bank, wealth management firm, or insurance provider, effectively communicating complex financial products can be a challenge. AR can transform client interactions, making them more engaging and intuitive. Advisors could, for example, overlay an interactive portfolio breakdown on a desk or conference table, allowing clients to physically “walk around” their investments, explore growth projections, or simulate market fluctuations in real time.

Stronger Competitive Edge

With fintech advancements accelerating, staying ahead of the competition often comes down to who can adopt innovative technologies first. AR adoption in the financial sector is still in the early stages, meaning there is significant potential for forward-thinking institutions—and individuals—to gain a competitive advantage. Early adopters can capture new customer segments, improve operational efficiency, and attract top-tier talent looking to work with cutting-edge tools.

3. Key Use Cases of AR in Financial Services

3.1 Trading and Investment Analysis

Augmented Data Overlays: Imagine standing in a trading room and receiving real-time financial data overlaid onto a physical stock ticker or your desk. Traders can visualize key metrics—like volume, price changes, and market depth—right in their field of view. This heightened sense of situational awareness can enable faster and more informed decision-making.

3D Chart Visualization: Complex candlestick charts and volume indicators can be displayed as 3D visuals. With gestures, analysts can drill down into specific data points, animate trends over time, or simulate market scenarios for improved forecasting.

3.2 Retail Banking

AR-Enhanced Banking Apps: Retail banks can develop AR functionalities within mobile banking apps, allowing customers to locate ATMs or branches by simply pointing their smartphone cameras in a certain direction. AR overlays can also display account balances or transaction histories on printed bank statements, creating a more interactive user experience.

Immersive Customer Service: In-branch AR experiences could provide customers with guided tours, showing them how to fill out forms or explaining complex financial products with real-time pop-ups and animations.

3.3 Insurance and Claims Processing

Claim Assessments: Insurance adjusters can use AR technology to assess vehicle damage, document incidents, and create accurate repair estimates on the spot. This accelerates the claims process, reduces errors, and provides a tangible return on investment.

Policy Education: Explaining insurance coverage can be daunting. AR can illustrate potential risks and coverage benefits, making it easier for policyholders to understand what they’re paying for and encouraging them to purchase additional coverage that aligns with their needs.

3.4 Wealth Management and Advisory

Portfolio Demonstrations: Advisors can overlay client portfolios onto a conference table, visualizing asset allocations, performance metrics, and potential outcomes under various market conditions. This interactive approach tends to improve client satisfaction and retention.

Goal Tracking: AR can help clients track their financial goals (such as saving for retirement or buying a house) with dynamic visuals. Seeing how small changes in contributions or market movements affect future outcomes can motivate clients to stick to long-term financial plans.

4. How to Make Money with AR in Finance

4.1 Offering Premium AR-Based Services

As AR becomes more integrated into traditional financial services, many institutions will likely offer AR-based services as part of a premium package. For example, you could charge a premium for real-time market overlay tools, advanced 3D visualization dashboards, or immersive customer service experiences.

Actionable Tip: If you’re a fintech entrepreneur or software developer, consider building AR solutions tailored to wealth management firms or trading platforms. Due to their niche functionality and value proposition, these specialized products can command higher subscription fees.

4.2 Differentiating Your Advisory or Trading Service

Adopting AR technology can help you stand out in a crowded marketplace if you're an independent financial advisor or a trader. Showcasing innovative AR-based analysis tools or offering AR-enabled consultations gives you a unique selling point (USP). This can justify charging higher fees, since you provide cutting-edge insights and a more interactive client experience.

Actionable Tip: Collaborate with AR developers to create proprietary visualization tools that overlay financial data on everyday surfaces. Leverage these tools in client pitches to demonstrate real-time analytics that few other advisors or traders can match.

4.3 Sponsorships and Partnerships

Sponsoring AR events or partnering with AR platform providers can open up new revenue streams for larger financial institutions. Sponsoring AR-driven financial educational programs or co-branding AR apps can attract new customers. As the technology matures, these partnerships can lead to cross-promotion opportunities, affiliate marketing, and more diversified income.

Actionable Tip: Explore alliances with established AR companies or innovative start-ups. Jointly develop white-labeled solutions that can be resold to smaller banks, credit unions, or insurance companies, generating ongoing licensing revenue.

5. Investing in AR-Focused Companies

One of the more straightforward ways to make money from AR in finance is by investing directly in companies that specialize in AR hardware, software, or content. This could include:

- AR Hardware Manufacturers: These are companies that produce AR headsets, smart glasses, or other wearables. Their products power the immersive experiences upon which AR in finance relies. Companies that are big in the AR hardware space are Apple, Meta, Microsoft, Snapchat, HTC, and Sony.

- AR Software Platforms: Many start-ups and established technology firms provide platforms or frameworks that developers use to build AR applications. Unity, Unreal, Google, Apple

- Content Creation Studios: AR content creation—be it graphics, simulations, or immersive data visuals—is a thriving niche. Studios that excel in this space are poised for rapid growth as demand for high-quality AR experiences increases.

5.1 Publicly Traded Stocks and ETFs

Many large tech companies have AR initiatives, making them attractive investment targets. Additionally, a growing number of exchange-traded funds (ETFs) focus on augmented and virtual reality technologies. Before investing, conduct thorough research on the company’s financials, roadmap, and the competitive landscape.

5.2 Venture Capital or Angel Investments

If you have significant capital and a higher risk tolerance, you could invest in AR start-ups at an earlier stage. While this path demands more due diligence and patience, the returns can be substantial if the start-up succeeds. Monitor fintech incubators or accelerators focusing on AR innovations in finance for promising opportunities.

6. Building and Selling AR Solutions

6.1 Developing AR Tools for Financial Institutions

Software developers and tech entrepreneurs can profit by building AR solutions that cater to financial institutions. Potential products might include an AR-enabled trading platform, a portfolio visualization tool, or an interactive client on-boarding system. These solutions can be licensed or sold outright to banks, brokerage firms, or insurance companies.

Monetization Approaches:

- Subscription Model: Charge a monthly or annual fee for continued access and updates.

- One-Time Licensing Fee: You can sell a perpetual license for large sums, especially to institutions that want full control over the software.

- White Labeling: Customize your AR software with the financial institution’s branding, allowing them to resell or distribute the product under their name.

6.2 Consulting and Implementation

Large financial institutions often require guidance on integrating AR technologies into existing workflows, IT systems, and compliance frameworks. If you have expertise in AR technology and financial regulations, you can position yourself as a consultant, charging hourly or project-based fees to help organizations successfully deploy AR solutions.

Key Areas of Focus:

- Software Integration: Ensuring AR tools integrate seamlessly with legacy systems.

- Regulatory Compliance: Addressing privacy, security, and data protection standards.

- Training and Change Management: Helping employees adapt to new AR-driven processes.

7. Challenges and Considerations

7.1 Regulatory Hurdles

Finance is one of the most heavily regulated industries worldwide. Adding AR to the mix often raises questions about data privacy, cybersecurity, and compliance. Firms must ensure that AR applications meet all relevant guidelines, from the GDPR in Europe to FINRA rules in the United States. Understanding these regulations is essential for anyone looking to develop or implement AR solutions in finance.

7.2 Data Security

Data security is paramount with AR applications collecting and overlaying large amounts of real-time financial information. Financial institutions have to safeguard sensitive client data while preventing unauthorized access to market-moving insights. This may require end-to-end encryption, biometric authentication, and regular security audits.

7.3 Technology Limitations and User Adoption

Although AR technology has progressed substantially, hardware limitations—like battery life, field of view, and comfort—can still hinder widespread adoption. Additionally, financial professionals and customers may hesitate to adopt a new technology that disrupts traditional workflows. Addressing these concerns with user-friendly designs, adequate training, and clear communication is critical.

7.4 Cost of Development and Maintenance

High-end AR solutions often require a specialized skill set and robust infrastructure, potentially translating into significant upfront costs. Maintenance can also be costly, particularly if you offer real-time data overlays requiring frequent updates. Proper budgeting and strategic planning can help mitigate financial risks.

8. The Future of AR in Finance

Augmented reality is poised to reshape finance in ways we’re only beginning to imagine. As AR hardware becomes more compact, cost-effective, and powerful, financial institutions will integrate it more deeply into daily operations. Emerging technologies such as 5G and edge computing will also accelerate AR adoption by reducing latency and enabling richer, more immersive experiences.

8.1 AR and Artificial Intelligence Convergence

Combining AR with artificial intelligence (AI) will enhance predictive analytics, automated trading, and robo-advisory services. Advanced algorithms can power sophisticated overlays highlighting high-probability trade ideas or providing real-time risk assessments. This convergence will give traders, analysts, and clients unprecedented data insights, making financial decision-making more efficient and potentially more profitable.

8.2 Expansion Beyond Banking

Look for AR to expand into other financial domains, like cryptocurrency exchanges, crowdfunding platforms, and micro-investment apps. Innovations such as blockchain can provide transparent, secure environments for AR-driven transactions. Likewise, AR property walkthroughs and interactive loan simulations may benefit real estate financing and mortgage lending.

8.3 Global Collaboration

AR will make remote collaboration far more immersive, enabling financial professionals across the globe to share data visualizations, interact with 3D dashboards, and simulate economic scenarios as if they were in the same room. This could foster more rapid financial innovation and open up cross-border investment opportunities, further driving revenue growth.

9. Conclusion

Augmented reality holds immense potential to transform the finance industry, offering new revenue streams, enhanced customer engagement, and more efficient operations. From immersive data visualization and AR-based advisory services to investing in AR technology providers, individuals and institutions can capitalize on this trend in multiple ways.

Key Takeaways

- Data Visualization: AR-driven 3D charts and overlays can help traders, analysts, and advisors discover hidden market opportunities and make faster, better-informed decisions.

- Client Engagement: Augmented reality provides a more intuitive and interactive way for financial professionals to communicate complex information, increasing client trust and retention.

- Investment Opportunities: Investing in AR hardware manufacturers, software platforms, or start-ups can yield significant returns as the technology matures and adoption accelerates.

- Build or Consult: Entrepreneurs and developers can create AR solutions tailored to finance, while consultants can guide financial institutions in implementation, ensuring regulatory compliance and seamless integration.

- Future Growth: Ongoing developments in AI, 5G, and other emerging technologies will continue to expand AR’s capabilities, making it a crucial component of tomorrow’s financial landscape.

As AR technology advances and becomes more accessible, the question is no longer if augmented reality will play a role in finance, but rather how quickly you can benefit from it. Whether you are an investor, a financial advisor, a software developer, or an entrepreneur, tapping into the potential of augmented reality in finance can open doors to profitable opportunities. By staying informed, thinking creatively, and acting decisively, you can make money using augmented reality while shaping the future of finance for years to come.

TALK TO A PRO

We're here to bring your brand to life!

Stay Connected with BrandXR

Create Augmented Reality for Free!

Create, Publish, and Measure 3D Augmented Reality Experiences Without Having to Code.