Advances in OOH Advertising Technology Since the Internet: A Chronological Review

Introduction

Out-of-Home (OOH) advertising – encompassing billboards, transit signs, and digital displays – has experienced a remarkable technological evolution since the internet's emergence in the early 1990s. As consumers became increasingly connected online, the traditionally static OOH medium began incorporating digital capabilities to maintain its relevance and effectiveness. This research report, directed at OOH advertising executives and Fortune 1000 marketing leaders, chronicles key advancements in OOH technology in the U.S. (with global comparisons) over the past few decades. It emphasizes high-level trends and widely adopted technologies, including digital billboards, programmatic digital OOH (DOOH) buying, geolocation and mobile integrations, data-driven targeting, augmented/virtual reality (AR/VR) enhancements, improved measurement and attribution, and the growing role of artificial intelligence (AI). The objective is to illustrate how OOH advertising has evolved from static posters into a dynamic, data-driven channel, while providing insight into the industry's future direction headed.

1990s: Laying the Groundwork in a Connected World

In the 1990s, the rise of the Internet did not immediately change the predominantly analog nature of out-of-home (OOH) advertising, but it laid the groundwork for future innovation. During this era, OOH advertising in the U.S. was still dominated by static billboards, posters, and transit signage. The decade witnessed ongoing investment in traditional formats (such as vinyl billboards replacing paper for enhanced durability) and iconic illuminated signs (like the neon-lit billboards in Times Square). While OOH remained a physical medium, the emerging digital revolution suggested new possibilities. Initial digital signage experiments began to appear in high-traffic areas—for instance, electronic displays in locations like Times Square and Las Vegas—but these were custom installations rather than widespread advertising networks. The OOH industry acknowledged the Internet’s potential to facilitate remote content control and data sharing, even though the technology was not yet prepared for mainstream use. By the late 1990s, companies were investigating how new digital display technologies (like LED screens) and internet connectivity could eventually be applied to billboards. These early endeavors set the stage for the digital out-of-home revolution that would unfold 2000s.

Early 2000s: The Advent of Digital Billboards

The early 2000s marked a pivotal turning point as digital billboards made their entrance, fundamentally transforming out-of-home (OOH) advertising. Breakthroughs in LED display technology and reduced electronics costs reached a tipping point around 2000, suddenly making large-format digital screens economically viable for outdoor use. In 2001, Lamar Advertising installed the industry’s first large digital billboard, a low-resolution LED display in Baton Rouge, Louisiana; this groundbreaking pilot demonstrated the concept’s potential. Over the next few years (2001–2004), major OOH companies trialed digital displays in select markets, refining the technology and demonstrating a return on investment. By 2004–2005, costs had decreased and reliability improved to the point that digital billboards entered a phase of rapid growth, with manufacturers shipping dozens of units per week to meet demand demand.

These LED billboards offer several advantages over traditional static signs. They are bright, eye-catching, and visible even in daylight, allowing multiple ads to rotate in the same location and multiplying revenue opportunities for operators. For advertisers, digital screens provide flexibility that was previously unheard of in traditional out-of-home (OOH) advertising—content can be updated remotely in real-time, eliminating the costs and delays associated with replacing printed vinyl. By the late 2000s, major U.S. cities and highways were dotted with digital billboards, enabling advertisers to experiment with creative digital content, such as animated visuals or countdown clocks, to better engage passersby. This trend was mirrored globally in other markets, from the bright digital facades of Tokyo and London to the digital screens in emerging markets, although the U.S. remained a leading adopter. Consequently, OOH ad spending began to shift toward digital formats. (As a reference point, global OOH advertising revenue was approximately $30 billion in 2017 and continued to grow, with over 25 million digital OOH units deployed worldwide by 2018.) Today, in the U.S., roughly one-third of all OOH ad spending is on digital formats, reflecting how quickly digital billboards have become a cornerstone of the industry.

Late 2000s: Networking, Geolocation and Mobile Integration

As digital screens proliferated in the late 2000s, the focus shifted to connecting OOH with the mobile revolution. The introduction of smartphones (after 2007) and widespread mobile internet access created new opportunities to link outdoor ads with consumers’ devices. OOH operators began equipping digital signage with network connections and software to enable more sophisticated content control, scheduling, and targeting. By leveraging live data feeds, billboards could start to display contextually relevant messaging – for example, showing weather-specific ads (such as a coffee ad on a cold morning) or real-time information like news and sports scores. This period also saw OOH campaigns encouraging viewers to engage via their phones. Simple integrations emerged: SMS short codes on billboards to request more information, or the appearance of QR codes and social media handles on OOH posters. Such tactics bridged physical ads with digital engagement, foreshadowing deeper mobile integration to come.

A major development was the use of geolocation and geofencing to enhance the impact of out-of-home (OOH) advertising. By leveraging the GPS capabilities of smartphones and location data, advertisers discovered they could retarget individuals exposed to OOH ads with follow-up advertisements on their mobile devices. In practice, this involved setting up virtual perimeters—known as "geofences"—around OOH units: when a user’s phone entered that area, it could trigger a relevant mobile ad or later determine if that user visited a store. By the end of the decade, early adopters were combining OOH and mobile campaigns to increase engagement. For instance, an outdoor billboard could be synchronized with in-app ads, ensuring that audiences received a coordinated message on their phones after viewing the billboard. This convergence of OOH and mobile advertising significantly improved measurability and targeting in what was previously an untrackable medium. Industry research indicated that mobile click-through rates rose substantially (with some studies reporting increases of 15% or more) when supported by OOH ads, thanks to these retargeting methods. Location data from carriers, apps, and sensors became “the secret sauce,” providing insights into audience movement and enabling OOH to approach one-to-one marketing. By 2010, the OOH industry was actively welcoming mobile integration, paving the way for the data-driven era of the 2010s.

2010s: The Rise of Programmatic and Data-Driven DOOH

The 2010s represented a transformative decade for OOH advertising, as digital technology, data, and automation converged to establish a genuinely smart medium. By the early 2010s, a substantial number of digital billboards and place-based digital screens (located in malls, transit hubs, airports, etc.) were operational. This laid the foundation for programmatic Digital Out-of-Home (pDOOH) – the implementation of automated, data-driven ad buying for OOH inventory – similar to the changes already seen in online advertising. Around 2012, the first programmatic OOH platforms and exchanges were launched, allowing advertisers to buy digital billboard space via demand-side platforms (DSPs) and real-time bidding algorithms. Companies like Broadsign (in Canada) and Vistar Media (in the U.S.) led the way in connecting digital signage networks to programmatic buying systems. This development enabled marketers to log into a platform, set targeting parameters (location, time, audience demographics, budget), and automatically have their ads displayed on digital billboards across various operators. By the mid-2010s, programmatic DOOH gained traction, with major OOH networks making their inventory available for real-time, impression-based advertising buying.

Crucially, data became the lifeblood of OOH campaigns during the 2010s. Advertisers began utilizing a wealth of data sources to target OOH ads more precisely and contextually. Location data, aggregated from mobile devices, enabled brands to choose billboard locations based on the movements and demographics of the audience passing by. Advertisers could also schedule content according to factors like the time of day, the day of the week, or even weather and traffic conditions. For example, a fast-food chain could display coffee ads on digital screens during the morning rush and switch to dinner promotions by late afternoon, or a retailer could trigger ads for raincoats on a billboard when meteorological data indicates rain in that area. This data-driven flexibility introduced a level of targeting and timeliness to OOH that was previously unattainable. One industry report referred to this period as a “data-driven revolution,” highlighting that programmatic ad platforms enabled OOH campaigns to target audiences with precision based on location, time, and weather, just as easily as online ads

Another significant advancement was in measurement and attribution. Historically, out-of-home (OOH) advertising was challenging to measure; advertisers relied on traffic counts or surveys to estimate impressions. During the 2010s, new tools emerged to quantify and link OOH audience exposure to outcomes. Mobile location data played a crucial role: if a user’s device was detected (anonymously) within view of a billboard and later appeared inside an advertiser’s store, that movement could be attributed to OOH influence. Specialized firms began offering OOH attribution services that tracked increases in store visitation or website visits among those exposed to an outdoor ad. Simultaneously, computer vision technologies made progress—some digital displays were equipped with sensors or cameras to count passersby or even estimate their demographics (gender, age range) by anonymously analyzing imagery. These camera-equipped “smart billboards” could then adjust content to suit the observed audience (e.g., displaying an eyewear ad if many viewers wore glasses) and provide detailed analytics on how many people looked at the screen. Thanks to these data and sensor innovations, by the end of the 2010s, OOH campaigns could deliver advertisers far more granular reports, including impressions, dwell time, and engagement metrics. As a result, OOH joined the omni-channel, ROI-driven digital ecosystem—a significant departure from the one-size-fits-all posters of the past.

From a business perspective, these capabilities fueled considerable growth in the DOOH sector. Advertisers invested more budget into OOH, knowing they could target and measure it like their digital ads. Programmatic buying also reduced the barriers to entry, attracting a broader range of advertisers, including small brands, to purchase billboard space in flexible, short-term increments. By 2019, analysts projected programmatic OOH would evolve into a billion-dollar segment, and overall OOH spending was on a steady upswing. Notably, global data indicated that both traditional and digital OOH were expanding, but digital was growing at a faster pace; by the mid-2020s, DOOH accounted for roughly 40% of global OOH revenue. In the U.S., the digital OOH revenue share reached about

30% of total OOH spending by 2023, recovering from a brief pandemic dip. The 2010s firmly established that the future of OOH would be digital, data-driven, and integrated with the same programmatic infrastructure as online advertising media.

Late 2010s: Immersive Experiences (AR/VR) and Interactive Innovations

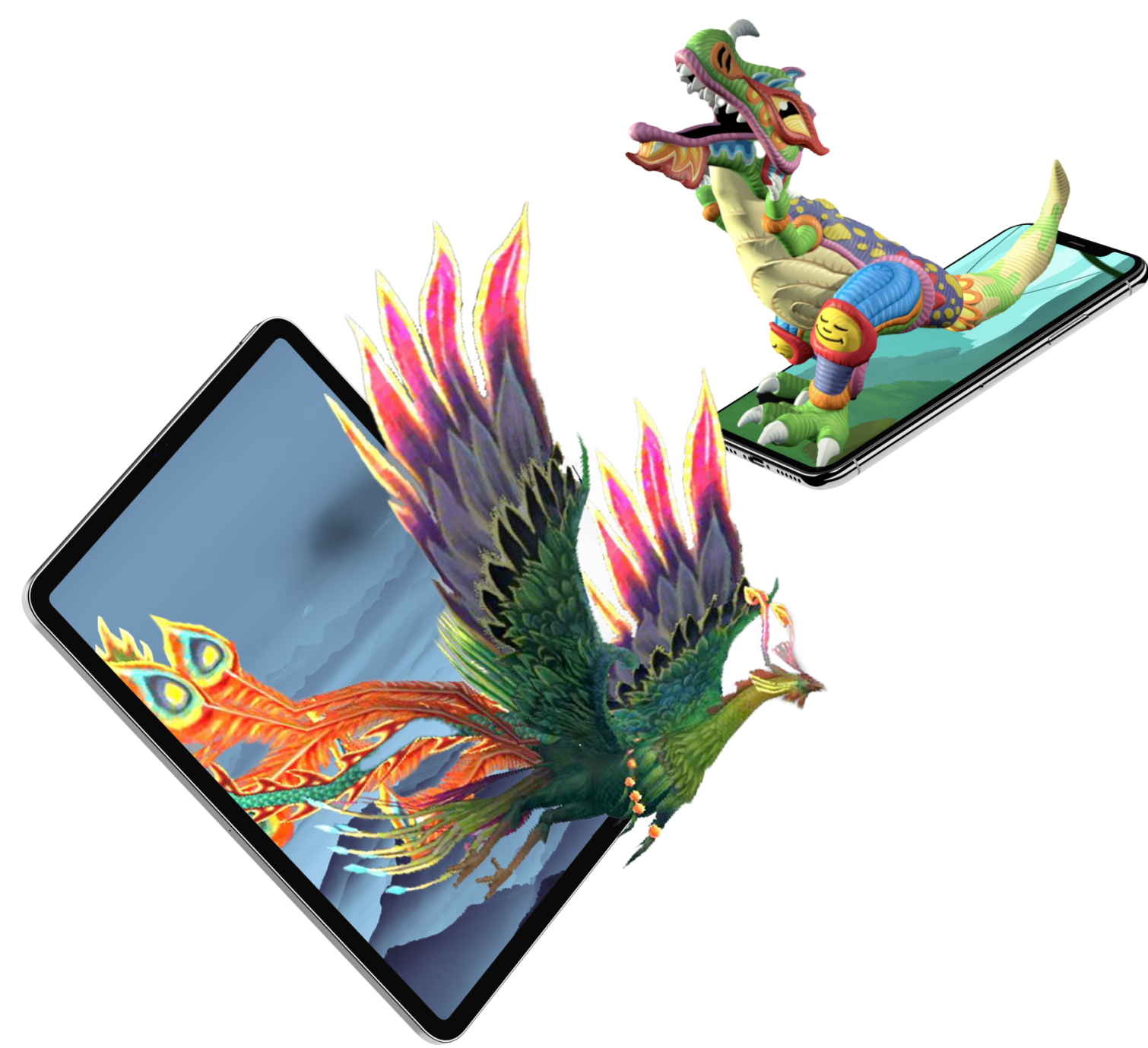

As OOH entered the late 2010s, marketers began to look beyond targeted ads and towards more immersive, experience-driven campaigns in public spaces. Two technologies, in particular, generated excitement: augmented reality (AR) and virtual reality (VR). OOH advertisers started to experiment with AR overlays to add a digital interactive layer to physical ads. A famous example was Pepsi’s 2014 London bus shelter ad, which used AR to create the illusion that fantastical objects (UFOs, tigers, robots) were interacting with the street scene through the shelter’s glass—delighting and shocking commuters who experienced it. This stunt, while unique, demonstrated how AR can transform a mundane ad space into a viral experience. Across the industry, AR began to appear in more campaigns: a mural on a wall might spring to life with 3D animations when viewed through a smartphone app, or a transit poster might trigger a mini-game or 3D product demo on the user’s phone. Interactive DOOH blurred the line between physical and digital, encouraging active audience participation and social sharing. VR, being more individual and headset-based, saw more limited use in OOH, but some brands implemented mobile VR kiosks or 360° video domes at events—extensions of OOH—to immerse audiences in virtual environments.

At the same time, digital displays became increasingly interactive. Touchscreen kiosks in shopping malls, transit hubs, and city sidewalks enabled people to engage directly with advertising content – for instance, browsing catalogs, playing games, or taking selfies to post on digital billboards. These installations often integrated with mobile apps and social media, extending engagement beyond the initial interaction. Another creative trend emerged with the rise of 3D digital billboards. In 2017, Coca-Cola unveiled a robotic 3D billboard in Times Square, featuring moving LED panels that created three-dimensional effects. Shortly after, 3D anamorphic content, which appears three-dimensional from certain angles, began to draw attention in Asian markets like Japan and China and later in the U.S. While these spectacular 3D boards remain relatively niche, they highlight the advancements in display technology. The late 2010s also witnessed out-of-home units integrating other sensory and interactive technologies, such as motion sensors that trigger content when someone walks by or voice recognition for spoken queries at an interactive kiosk.

Underpinning these eye-catching campaigns was the ongoing advancement of data and measurement. OOH analytics platforms became more sophisticated, integrating multiple data inputs (mobile location, cameras, beacon sensors) to provide advertisers with near real-time feedback and insights. Brands could see how an OOH campaign was driving foot traffic or engagement and adjust their creatives accordingly. This agile approach – “test, measure, optimize” – became as relevant to DOOH as it was to online ads. In brief, by 2020, the OOH advertising medium had transformed into a dynamic, interactive canvas. It could deliver not only messages but also experiences, precisely targeted with digital accuracy and assessed with a range of high-tech tools. As one industry expert noted, OOH had evolved into “100% viewable, fraud-free impressions in the real world,” merging the best of digital advertising (flexibility, targeting, analytics) with the impact of large-format physical media presence.

2020s: AI and the Next Frontier of OOH Integration

In the 2020s, OOH advertising continues to innovate rapidly, with artificial intelligence (AI) taking center stage in many new capabilities. AI and machine learning are applied to optimize almost every aspect of OOH campaigns. On the creative side, AI algorithms can adjust digital billboard content in real-time based on incoming data, effectively automating the decision of which ad to show at any given moment to maximize relevance. This might involve AI analyzing traffic patterns, weather, or local events, then choosing the most appropriate creative from an advertiser’s portfolio—for example, detecting a sports game letting out and displaying an ad for a nearby restaurant to hungry fans. AI-driven dynamic creative optimization enables a level of contextual personalization at scale that manual scheduling could never achieve. In some cases, AI vision systems gauge the audience in front of a screen via anonymized camera feeds and adjust content accordingly—e.g., recognizing the approximate age/gender mix of the crowd and selecting an ad that historically performs well with that demographic. Major OOH operators are careful with privacy in these implementations, often avoiding the storage of any personal data, but the technical capability to tailor ads “on the fly” using AI is now a reality. This AI-driven personalization is expected to grow, delivering content that not only matches broad demographic data but also adapts to factors like audience mood or preferences when such signals are available available.

On the buying and planning side, AI is enhancing how campaigns are planned and optimized. Predictive algorithms analyze vast amounts of location data, past campaign performance, and consumer behavior patterns to recommend the best spots and times for a campaign, or to automatically allocate budgets across a network of digital screens for maximum impact. Some DSPs for programmatic DOOH now provide AI-based optimizations that adjust bids and targeting criteria in real-time, responding to real-world conditions (similar to how online programmatic AI operates). AI is also further improving measurement and attribution: for instance, by modeling complex consumer journeys that involve exposure to multiple touchpoints (OOH, mobile, online) and assigning credit to OOH exposures for eventual conversions (like a store visit or sale). These multi-touch attribution models assist marketers in better understanding OOH’s role in the mix and justifying their investments with data.

Another trend of the 2020s is the push for greater integration of OOH in omnichannel marketing. Brands are increasingly planning OOH alongside digital, TV, and social campaigns as one cohesive strategy. The same data management platforms that store online customer data are now linking with OOH networks, allowing a brand to retarget a customer who visited their website with a digital billboard ad the following day, for instance. The capability to “bridge online and offline” has truly arrived—mobile IDs or other proxies can connect online impressions to out-of-home exposures, creating a seamless brand experience. This integration is supported by industry initiatives and common standards (such as the OpenRTB protocol extensions for DOOH) that facilitate the purchasing of OOH inventory within the same systems as online ads.

Finally, it’s important to consider some global perspectives and forward-looking insights. The U.S. remains one of the largest OOH advertising markets, but other regions often provide a glimpse into the future. For instance, in parts of Asia-Pacific and Europe, DOOH growth has outpaced that of the U.S., with some countries reporting that more than half of OOH ad spend is now digital. These markets have also taken the lead in innovations like large-scale interactive outdoor projections, holographic 3D displays, and smart city partnerships, where digital kiosks offer public information and advertising simultaneously. As cities modernize, the U.S. is quickly adopting many of these advancements. There is also a growing trend toward sustainability in OOH technology—implementing solar-powered digital billboards, more efficient LEDs, and smarter lighting to minimize energy consumption. As smart city infrastructure expands, we can anticipate OOH displays to serve multiple purposes, including showcasing ads, civic messages, and sensor-driven alerts platform).

In summary, the 2020s so far have solidified OOH’s transformation into a fully digital, data-enabled medium. Today’s OOH campaigns are planned with rich data, executed programmatically, customized by AI, and measured with online-like precision. Yet, they also continue to deliver the mass reach and real-world impact that initially made OOH appealing. This combination of

physical presence

and

digital intelligence is making OOH a uniquely powerful channel in modern advertising marketing.

Conclusion and Future Outlook

Since the inception of digital billboards in the early 2000s to the AI-enhanced, hyper-connected networks of today, out-of-home (OOH) advertising has transformed for the Internet age. What was once a static analog format is now a dynamic, tech-driven medium that can engage a smartphone-wielding public in real time and with exceptional relevance. Executives and marketing leaders should consider a few key takeaways from this evolution:

- Digital Transformation is Mainstream: Digital out-of-home (OOH) screens have become ubiquitous and are now a standard element of advertising campaigns. They provide flexibility in content and creative opportunities that are impossible with static posters (e.g., day-parting ads, live content, multiple rotating brands). Marketers can treat OOH as a real-time tool medium.

- Data and Programmatic Enable Precision: The integration of data—from location and weather to audience demographics—allows OOH to be targeted and optimized almost like digital ads. Programmatic platforms have automated the buying process, making OOH easier to incorporate into omnichannel strategies and enabling quick pivots in campaigns.

- Mobile and OOH are Complementary: Instead of viewing OOH and mobile as separate entities, the industry now integrates them to enhance impact. Geofencing and retargeting connect outdoor exposures to mobile interactions, merging the physical and digital realms for a unified consumer journey. This synergy increases ROI by guiding consumers down the funnel from awareness (billboard) to action (mobile ad or website).

- Measurement and Attribution Have Greatly Improved: Modern OOH campaigns can demonstrate their value with concrete metrics. Impression counts are validated with sensors and mobile data, and foot traffic or sales increases can be linked to those who viewed an OOH ad. This level of accountability makes OOH more appealing to data-driven advertisers and CFOs who are scrutinizing budgets.

- Emerging Tech Enhances Engagement: AR and interactive DOOH executions, though not present in every campaign, have demonstrated how OOH can create memorable brand experiences and generate social buzz beyond a traditional ad. As AR glasses and other technologies develop, OOH could become a pivotal point for immersive content on the consumer’s own device. Brands that utilize these experiences can capture attention in ways that competitors may not miss.

- AI and Automation are the Future: Developments in the early 2020s indicate that AI will play a major role in OOH, whether through automating campaign optimization or enabling highly personalized real-time content delivery. Executives should invest in AI capabilities and partnerships now to stay ahead of the curve, as AI-driven OOH could significantly increase efficiency and effectiveness campaigns.

Looking ahead, the

OOH industry’s future is promising. We can anticipate further convergence of digital and physical channels, as well as more interactive and “smart” billboards—potentially featuring voice interactivity or built-in augmented reality—and continued global growth in OOH ad spending as advertisers seek impactful, real-world touchpoints. In an increasingly saturated online ad space, with concerns about ad fraud and viewability, OOH provides a tangible, guaranteed way to reach audiences—now enhanced by digital targeting and measurement. The next decade may introduce innovations such as displays targeted at autonomous vehicles, increased use of

3D holographic signage, and deeper integration with smart city infrastructures. The common thread is that technology will continue to enhance OOH’s capabilities while maintaining the core value of the medium: reaching consumers on the move in the real world in a bold and unmissable way. As one OOH slogan aptly states, "OOH is the oldest new medium.” After thousands of years, it remains about messages in public spaces—but as this report has demonstrated, the delivery and optimization of those messages have evolved in truly transformative ways in the post-Internet era. OOH executives who embrace these technologies will be best positioned to capture marketers’ growing demand for innovative, data-driven outdoor campaigns in the coming years.

TALK TO A PRO

We're here to bring your brand to life!

Stay Connected with BrandXR

Create Augmented Reality for Free!

Create, Publish, and Measure 3D Augmented Reality Experiences Without Having to Code.