Out-of-Home Advertising in the Middle East

The Middle East's out-of-home advertising market is experiencing a dramatic transformation as traditional billboards give way to digital displays and augmented reality experiences. Saudi Arabia and the UAE are leading this revolution with combined OOH investments exceeding $380 million annually and DOOH growth rates of 16-23%, which far surpass global averages. This shift represents more than just technological evolution—it signals a fundamental reimagining of how brands connect with consumers in the world's most digitally advanced region. These Middle Eastern innovations build upon global augmented reality advertising frameworks and accelerate trends documented in our business case for augmented reality advertising in 2025. The regional success patterns provide valuable insights for brands implementing AR billboard campaigns and AR mural installations in markets worldwide, demonstrating scalable approaches to location-based immersive advertising.

Government mega-projects like Saudi Vision 2030 and the UAE's smart city initiatives are driving unprecedented infrastructure investments, creating prime advertising opportunities that attract global attention. The region's unique mix of high smartphone penetration (99%), massive public infrastructure projects, and culturally sophisticated audiences is boosting advertiser ROI metrics that consistently surpass traditional media channels. Digital OOH campaigns now achieve engagement rates six times higher than static billboards, while AR-enhanced experiences are elevating interaction rates beyond 30% in premium locations.

The economic significance extends far beyond advertising spending. These markets are establishing new global benchmarks for location-based advertising effectiveness, with Dubai and Riyadh emerging as testbeds for next-generation advertising technologies. Marketing executives can quantify the business impact of these regional innovations using our AR advertising ROI calculator, which models how Middle Eastern engagement improvements translate to revenue growth in other markets. The strategic implications extend to 2025 metaverse marketing strategies for Fortune 500 brands, where location-based AR serves as a foundation for comprehensive digital engagement ecosystems.

Traditional OOH market foundations drive regional growth

Saudi Arabia and the UAE have established themselves as the dominant OOH advertising markets in the Middle East, with a combined market value nearing $380 million in 2024 and infrastructure investments that outpace regional competitors. Saudi Arabia's traditional OOH market generates approximately $180-200 million annually, while the UAE's established market reaches $107.6 million, representing 16% and 12% of total advertising spending, respectively. These figures indicate mature advertising ecosystems with sophisticated infrastructure and established advertiser behavior patterns.

The market structure reveals intriguing regional dynamics. Saudi Arabia's larger geographic footprint and Vision 2030 infrastructure expansion drive higher absolute spending, while the UAE's concentrated urban density results in premium per-capita advertising rates of $15.48 compared to Saudi Arabia's $4.47. This difference reflects the UAE's mature market positioning and elevated location costs, particularly along corridors like Sheikh Zayed Road, where daily vehicle traffic exceeds 400,000.

Growth trajectories position both markets for continued expansion through 2030. Saudi Arabia is projected to achieve an annual growth rate of 6.19%, reaching $226.4 million by 2029, bolstered by significant urbanization initiatives and the Kingdom's economic diversification strategy. The UAE's more mature market demonstrates steadier growth at 4.31%, totaling $183.4 million, which reflects established infrastructure and optimized inventory utilization. Nevertheless, both markets significantly outpace global out-of-home (OOH) growth rates of 2-3% annually.

Geographic concentration shapes market dynamics in key urban centers. In Saudi Arabia, Riyadh's King Fahd Road accommodates 30% of the city's daily traffic, while Jeddah's King Abdulaziz International Airport processes 43 million passengers every year. The UAE's premium inventory is centered around Dubai's Sheikh Zayed Road and the Dubai Mall area, which attracts over 100 million visitors annually. Abu Dhabi's Corniche experiences daily footfall of over 50,000, providing consistent high-value advertising exposure.

The format of distribution reflects evolving advertiser preferences and infrastructure capabilities. Transit advertising leads both markets with a 23% market share, leveraging extensive airport, metro, and highway networks. Static billboards hold a 25-30% market share but are under pressure from digital alternatives. Street furniture and place-based advertising represent 15-20% and 10-15% respectively, with growth concentrated in high-footfall commercial areas and transportation hubs.

Major infrastructure projects significantly amplify market potential. JCDecaux's exclusive control of all 26 Saudi airports, along with Dubai International, creates premium inventory aimed at affluent travelers. The company's King Fahd Causeway concession and 320-lamppost network along Jumeirah Beach Road demonstrate strategic positioning in high-value locations. Regional players such as Saudi Signs Media have secured 2,688 digital screens across the 448 carriages of Riyadh Metro, reaching 18 million passengers monthly.

Market consolidation trends benefit established players with substantial infrastructure investments. JCDecaux leads the international market through airport exclusivity agreements and control of strategic locations. Saudi Signs Media dominates domestic market growth through digital transformation initiatives and partnerships with the government. UAE's Hills Advertising and Emirates Neon Group maintain a strong regional presence across multiple emirates and neighboring Gulf markets.

Economic fundamentals support the continued expansion of the traditional OOH market. Both countries have urbanization rates exceeding 85%, leading to concentrated audiences that are ideal for location-based advertising. Government infrastructure spending—including $3 trillion targeted for foreign investment in Saudi Arabia and ongoing UAE smart city development—provides essential support systems for the expansion of advertising infrastructure. Rising tourism targets of 100 million visitors to Saudi Arabia by 2030 and Dubai's goal of 25 million visitors create additional demand for premium inventory.

DOOH transformation reshapes market dynamics and consumer engagement

Digital out-of-home advertising is revolutionizing marketing landscapes in the Middle East, with annual growth rates of 16-23% positioning the region among global leaders in DOOH adoption. The MENA DOOH market reached $335.59 million in 2024 and is projected to expand to $717.40 million by 2029, reflecting a compound annual growth rate of 16.41% that significantly outpaces global averages. This transformation reflects more than just technological upgrades—it signifies fundamental shifts in how advertisers approach location-based marketing in increasingly connected urban environments. These adoption patterns mirror successful implementations documented in our retail AR research, where similar digital transformation principles drive customer engagement and conversion improvements. Understanding consumer comfort with digital experiences, as evidenced through smart glasses adoption and AR navigation usage, helps explain the regional readiness for sophisticated OOH advertising technologies.

Consumer engagement metrics validate DOOH's superior performance over traditional formats. Regional studies show that 85% of UAE consumers recall DOOH advertisements encountered during commutes, while 62% report noticing digital displays and are 63% more likely to take online action after exposure. These engagement rates translate into measurable business outcomes, with DOOH campaigns delivering six times higher engagement than static billboards and conversion rates improving five to six times compared to traditional OOH methods.

The technology adoption curve highlights sophisticated implementation strategies in both markets.

Saudi Arabia's DOOH infrastructure investments concentrate on large-scale installations that support Vision 2030 urbanization goals. The Kingdom's digital transformation encompasses 8m x 8m screens in key locations such as Dammam and Khobar, along with comprehensive metro advertising networks spanning Riyadh's six lines. Advanced installations incorporate AI-driven content management that enables real-time optimization based on weather conditions, traffic patterns, and demographic data. These

AI-enhanced immersive experiences demonstrate sophisticated

AI-powered personalization at scale, where machine learning algorithms adapt content for maximum relevance and engagement. The technology principles apply across applications, from OOH advertising to

retail AR implementations and

manufacturing efficiency improvements.

The UAE's DOOH ecosystem emphasizes a premium experience and technological sophistication. Dubai's Sheikh Zayed Road corridor features high-resolution displays designed for luxury brand campaigns, while installations at Dubai Mall attract over 80 million annual visitors with their interactive capabilities. The emirate's deployment of a 5G network—among the fastest in the world—enables advanced applications, including AR integration and real-time programmatic advertising adjustments.

Programmatic DOOH adoption is accelerating across both markets as advertisers seek measurable performance metrics. Automated buying platforms enable day-parting strategies and multiple ad copy rotations for contextual communication based on real-time conditions. Proximity allocation systems ensure greater audience attention through intelligent content delivery aligned with traffic patterns and demographic concentrations. AI-driven analytics provide detailed engagement tracking, including dwell time, demographic profiling, and conversion attribution.

Infrastructure development projects generate unparalleled advertising opportunities. Saudi Arabia's NEOM mega-project features state-of-the-art DOOH systems as essential components of the city's infrastructure. Riyadh Metro's extensive digital network accommodates 18 million passengers each month via 2,688 screens distributed across 448 carriages. The UAE's smart city initiatives combine digital advertising with urban services, creating seamless experiences that enhance both city functionality and brand engagement.

Market transition dynamics reveal an accelerating shift from traditional to digital formats. Approximately 50% of current OOH investments now target DOOH installations, with this percentage expected to reach 70% by 2027. Advertiser preference reflects DOOH's measurability advantages, including 100% viewability compared to online video advertising's 50% viewability rates. Enhanced targeting capabilities through the integration of demographic and behavioral data provide precision that is unavailable through traditional billboard campaigns.

Investment patterns demonstrate a sustained commitment to digital transformation. Recent major deals include Media World and RSG Group's AED 100+ million partnership for premium Sheikh Zayed Road installations. Al Arabia OOH secured significant contracts with Dubai's Roads and Transport Authority, expanding digital coverage across transportation networks. Promomedia's January 2024 launch of 16 LED-equipped displays at Qatar's Al Maha Island indicates regional expansion of sophisticated digital infrastructure.

Consumer behavior analysis reveals a strong preference for interactive and contextually relevant advertising experiences. DOOH's superior recall rates of 82%, compared to traditional OOH's 45-60%, demonstrate enhanced memory formation through dynamic content and strategic timing. Weather-responsive content significantly increases engagement rates, while time-of-day optimization—morning coffee advertisements and evening restaurant promotions—shows measurable improvements in conversion rates.

Technical capabilities continue to expand through integration with emerging technologies. 3D anamorphic displays create spectacular visual experiences in premium locations, while touch-screen functionality enables direct consumer interaction and data collection. QR code integration bridges physical and digital experiences, and social media sharing capabilities amplify campaign reach beyond initial exposure. Real-time content management systems allow for immediate campaign adjustments based on performance metrics or external conditions.

Regional DOOH growth projections position Middle Eastern markets for continued global leadership.

Saudi

Arabia's DOOH market anticipates a 17% annual growth rate through 2029, driven by government digitization initiatives and major event preparations, including the FIFA World Cup 2034. The UAE's 14.64% DOOH growth trajectory reflects infrastructure optimization and a strong demand from premium advertisers for measurable, high-impact campaigns.

AR innovation and interactive solutions create new engagement paradigms

Augmented reality integration represents the next frontier in OOH advertising evolution, with global AR-enhanced OOH markets projected to reach $53.90 billion by 2030 at a 15.20% annual growth rate. These projections build upon proven implementations documented in our comprehensive case studies, where brands achieve measurable ROI through strategic AR deployment. The Middle Eastern success patterns provide frameworks applicable to [fashion industry AR implementationsand beauty brand AR mirror strategies, demonstrating cross-industry applications of location-based AR technology.

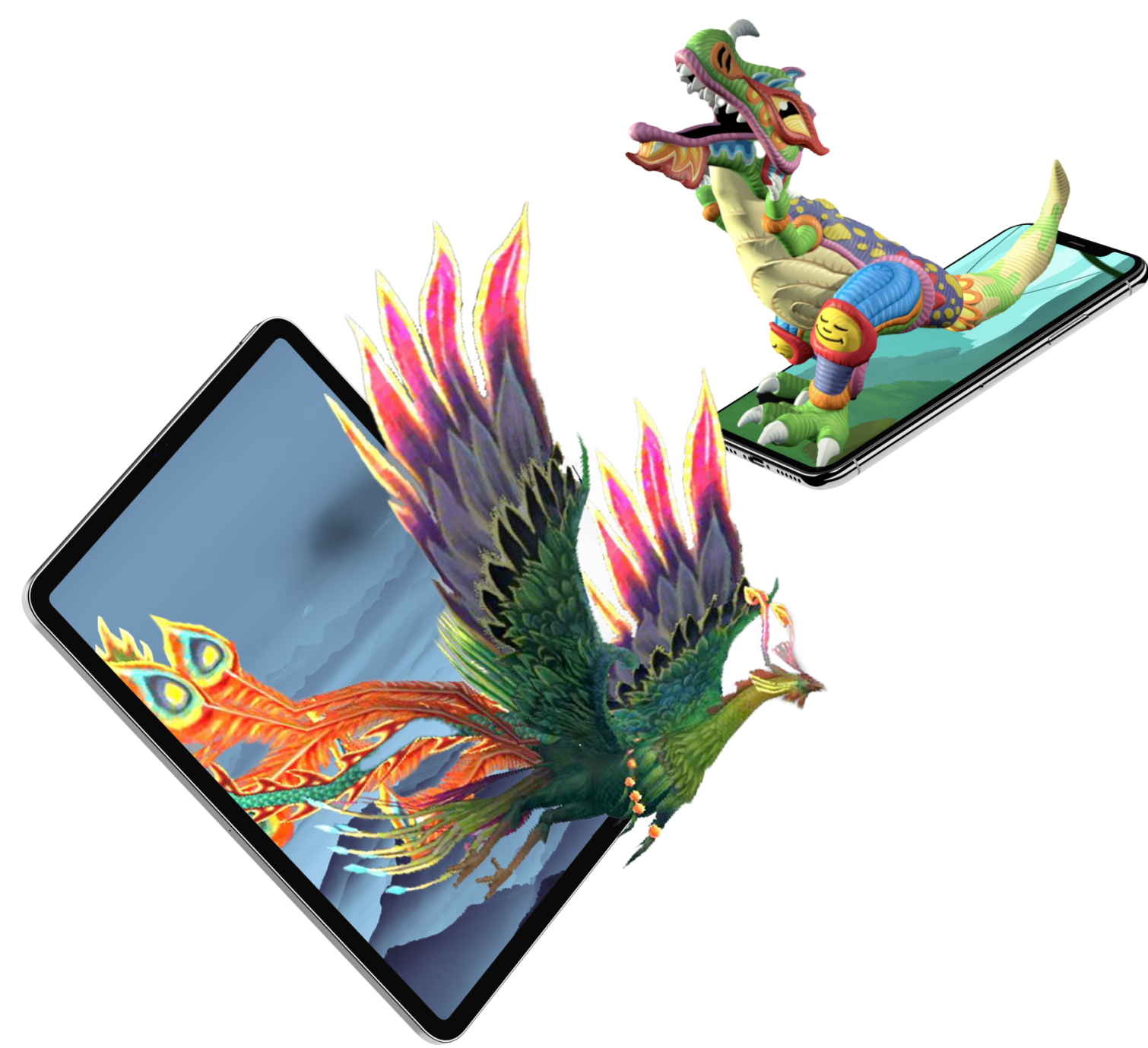

BrandXR has emerged as a leading platform that democratizes AR creation for OOH campaigns through no-code solutions, reducing development costs by 100 times and accelerating deployment timelines by 19 times compared to traditional AR development. The company's comprehensive offerings include AR Billboards, AR Murals, and AR Storefronts, specifically designed for location-based advertising applications. Beyond OOH campaigns, the platform supports social media AR filter creation and branded lens development, enabling integrated cross-channel AR strategies that amplify Middle Eastern market successes globally.

Technology implementation strategies emphasize reducing consumer friction while maximizing engagement impact. WebAR solutions eliminate the need for app downloads, enabling immediate interaction through smartphone cameras and QR code scanning. Image recognition technology transforms static billboards into interactive canvases, while 3D asset optimization guarantees smooth performance across various device capabilities. Social media integration facilitates direct sharing to Instagram, Snapchat, and TikTok platforms, amplifying campaign reach through user-generated content.

Performance metrics showcase AR's enhanced engagement capabilities compared to traditional advertising formats. Interaction rates soar to 28-32% in high-traffic locations, with data capture rates ranging from 70-85% for optimized AR experiences. Dwell time escalates significantly from 6-8 seconds for traditional billboards to 45-75 seconds for AR interactions. Campaign ROI indicates 20-35% annual returns after break-even periods, achieving conversion rates that are 11 times better than those of traditional web interactions.

Regional implementation examples demonstrate inventive applications tailored to local markets and cultural preferences. Travel brand Tumi's 3D anamorphic billboard campaign in Dubai showcased collision-effect displays promoting TEGRA-LITE luggage collections through January 2024. Interactive LCD/LED installations in Riyadh offer niche market targeting capabilities through 2m x 3m displays strategically positioned in key commercial locations. QR code and NFC tag integrations are particularly effective for automotive campaigns, where extended engagement times facilitate detailed product exploration.

A competitive landscape analysis reveals growing market participation among technology providers and creative agencies. Traditional competitors focus on QR code-based experiences, while 8th Wall delivers developer-focused web-based AR solutions. Adobe Aero provides design-centric capabilities integrated with Creative Suite workflows. BrandXR differentiates itself with no-code accessibility combined with comprehensive OOH specialization, making advanced AR capabilities available to marketing teams without technical expertise.

Implementation strategies require careful consideration of regional cultural norms and technological infrastructure. Support for the Arabic language and adaptation for right-to-left design ensure accessibility for local audiences. Moreover, cultural imagery requirements should align with Islamic principles and local customs. The availability of 5G networks allows for high-resolution AR content, while strategic placement takes into account prayer times, weather conditions, and traffic patterns specific to the lifestyle in the Gulf region.

Case study analysis shows measurable business outcomes from AR-enhanced OOH campaigns. The NBA's 75th Anniversary campaign generated over 50 million impressions and 18,000 user-generated videos within three weeks through Instagram filter integration. Brand recall rates rise by 70% after AR interactions, while social sharing rates increase by 300% compared to traditional advertising formats. These metrics translate into tangible business results, including showroom visits, website traffic, and purchase conversions.

Future development trends indicate an increase in AI integration and programmatic capabilities for AR advertising. Personalization engines will provide dynamic content based on demographic data, weather conditions, and real-time behavioral indicators. Integration of wearable devices—including Ray-Ban Meta Smart Glasses and similar products—will broaden AR accessibility beyond smartphone-dependent interactions. Machine learning algorithms will enhance content delivery timing and creative variations based on performance data and audience response patterns.

Investment requirements and ROI calculations indicate favorable economics for adopting AR advertising. Initial implementation costs of $35,000 to $100,000 compare favorably to traditional premium billboard installations when considering enhanced engagement metrics and measurable outcomes. Annual operational costs of $13,200 to $51,600 support sophisticated measurement and optimization capabilities that are unavailable through traditional formats. Break-even timelines of 3 to 12 months reflect accelerated adoption rates and improved cost efficiency.

Market opportunities significantly expand through integration with broader digital marketing ecosystems. Cross-channel attribution allows OOH campaigns to drive measurable digital engagement, with studies indicating a 40% improvement in online search effectiveness when combined with AR-enhanced location-based advertising. Omnichannel strategies utilize AR interactions to capture consumer data for follow-up marketing across email, social media, and programmatic display channels.

Regional growth projections position Middle Eastern markets for continued leadership in AR advertising. Government smart city initiatives provide essential infrastructure support, while high rates of consumer technology adoption ensure audiences are ready for interactive experiences. Major upcoming events, including Riyadh's Expo 2030 and the FIFA World Cup 2034, create opportunities for large-scale AR implementations that will set new global benchmarks for the effectiveness of immersive advertising.

Strategic recommendations and market outlook

The Middle East OOH advertising transformation demands strategic repositioning for brands seeking a competitive advantage in rapidly evolving digital landscapes. Executive decision-makers must prioritize investments in DOOH infrastructure while also exploring AR integration opportunities that differentiate campaigns and drive measurable improvements in engagement. The window for early-adopter advantages remains open but is closing rapidly as sophisticated competitors enter these high-growth markets.

Investment allocation strategies should focus on acquiring premium locations and developing digital capabilities. Brands with a significant regional presence need to quickly expand their DOOH portfolios, targeting high-traffic areas like Sheikh Zayed Road and King Fahd Road, where daily exposure exceeds 400,000 impressions. Secondary market opportunities in Abu Dhabi, Jeddah, and emerging cities in Saudi Arabia provide attractive cost-efficiency ratios for market expansion strategies.

Programmatic DOOH adoption signifies crucial competitive differentiation as automated buying platforms evolve. Organizations should foster relationships with leading programmatic providers while enhancing internal capabilities for real-time campaign optimization and performance measurement. Data integration across digital channels facilitates sophisticated attribution modeling that substantiates increased OOH investment allocation and informs strategic decision-making.

Cultural adaptation requirements require significant organizational attention and resource allocation. Successful market penetration necessitates a deep understanding of Islamic principles, Arabic language preferences, and regional lifestyle patterns. Content creation workflows should incorporate cultural review processes, while creative development teams must have regional expertise for authentic local market positioning.

Selecting a technology partnership is crucial for gaining a sustainable competitive advantage. BrandXR's no-code platform provides significant benefits for organizations without extensive technical resources, whereas traditional development methods are more suitable for brands with dedicated AR development teams. Evaluation criteria should focus on deployment speed, cost efficiency, measurement capabilities, and the integration options of platforms that align with existing marketing technology stacks.

Timeline considerations necessitate coordinated planning across various organizational functions. DOOH infrastructure development usually takes 12-18 months from planning to full deployment, whereas AR capability development can yield results within 3-6 months by utilizing no-code platforms. Major event marketing opportunities—Expo 2030, FIFA World Cup 2034—require immediate strategic planning to secure premium inventory and development resources.

Developing a measurement framework enables data-driven optimization and executive reporting that justifies continued investment. Organizations should establish KPI frameworks that include traditional metrics (reach, frequency, cost-per-impression) as well as enhanced engagement indicators (interaction rates, dwell time, conversion attribution). Advanced analytics capabilities, including demographic profiling and cross-channel attribution, offer competitive intelligence that is not available through traditional advertising measurement approaches.

Regulatory compliance strategies require ongoing monitoring and adaptive implementation. Both Saudi Arabia and the UAE continue to evolve their advertising regulations as digital capabilities expand and cultural standards adapt. Legal review processes must accommodate cultural sensitivities while ensuring technical compliance with local telecommunications and content standards.

Competitive positioning strategies should leverage first-mover advantages while markets remain fragmented. Organizations establishing a comprehensive DOOH presence today benefit from the availability of premium inventory and the development of relationships with key infrastructure providers like JCDecaux, Saudi Signs Media, and emerging regional players. Developing AR capabilities provides additional differentiation as competitors struggle with barriers to technical implementation.

Long-term strategic planning must consider the accelerating convergence of technology. The expansion of 5G networks enables increasingly sophisticated AR applications, while AI integration offers personalization capabilities that change advertising from broadcast to individualized communication. The development of smart city infrastructure creates advertising touchpoints that extend well beyond traditional billboard placements.

Market expansion opportunities are present throughout the broader MENA region, as the successful strategies of Saudi Arabia and the UAE serve as blueprints for nearby markets. Qatar, Kuwait, and Bahrain have similar demographic profiles and infrastructure development patterns that facilitate the replication of proven approaches with suitable cultural adaptations.

Executive leadership commitment is essential for successful market entry and expansion. The Middle East's OOH transformation requires sustained investment, cultural adaptation, and technology adoption across various organizational functions. Companies that achieve a sustainable competitive advantage demonstrate clear executive support, dedicated regional expertise, and a willingness to invest in emerging technologies ahead of mainstream adoption.

The convergence of government mega-projects, advanced digital infrastructure, and sophisticated consumer audiences creates unprecedented advertising opportunities in global markets. Organizations that position themselves strategically within this transformation will benefit from sustained competitive advantages as these markets mature and expand throughout the broader Middle East region.

TALK TO A PRO

We're here to bring your brand to life!

Stay Connected with BrandXR

Create Augmented Reality for Free!

Create, Publish, and Measure 3D Augmented Reality Experiences Without Having to Code.